How to Trade at Olymptrade for Beginners

How to Register at Olymptrade

How to Register with an Email

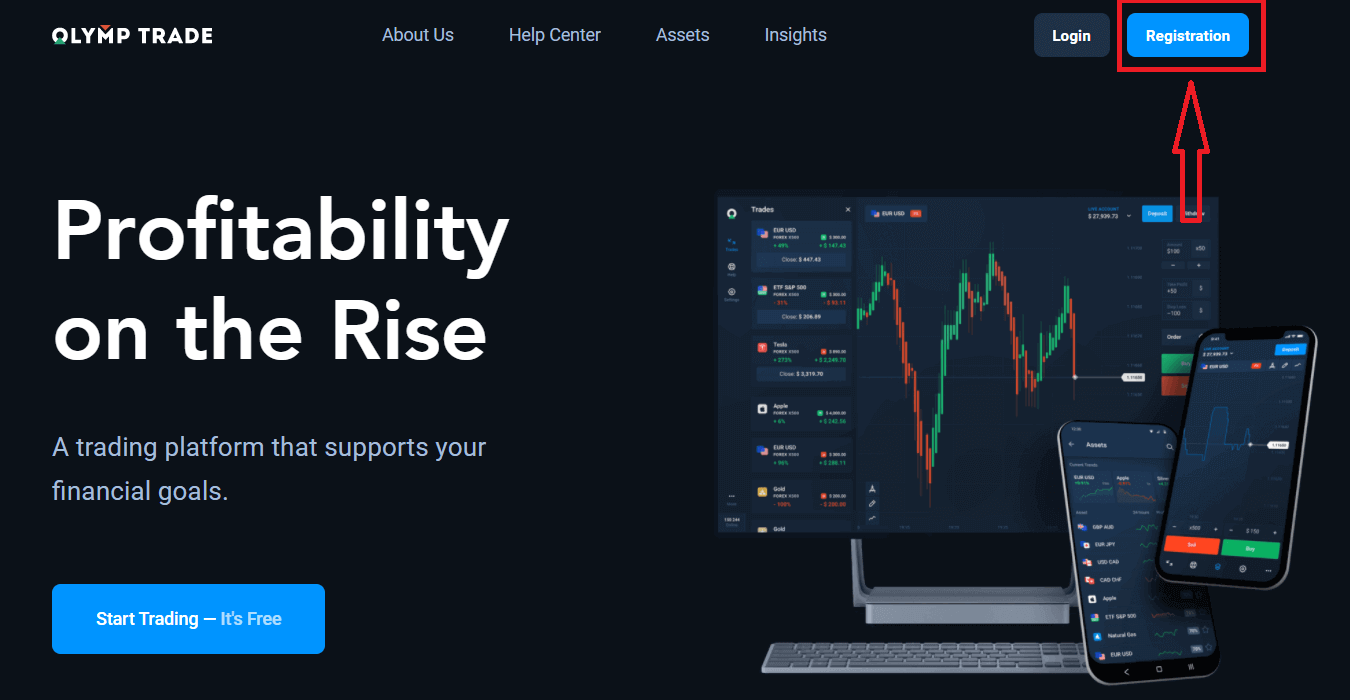

1. You can sign up for an account on the platform by clicking the “Registration” button in the upper right corner.

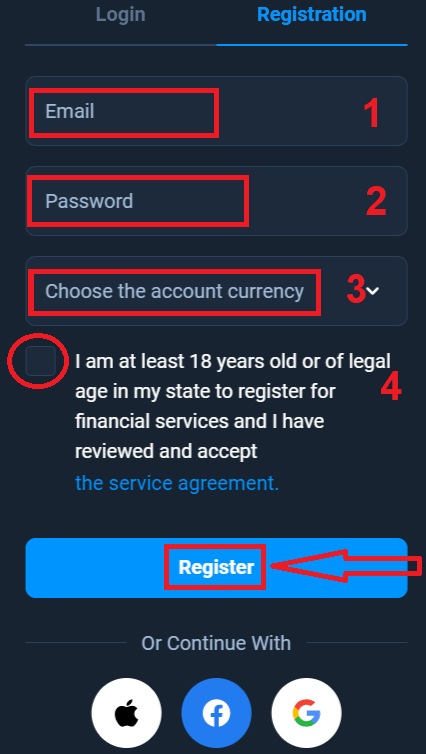

2. To sign-up you need to fill in all the necessary information and click "Register" button

- Enter a valid email address.

- Create a strong password.

- Choose the account currency: (EUR or USD)

- You also need to agree to the service agreement and confirm that you are of legal age (over 18).

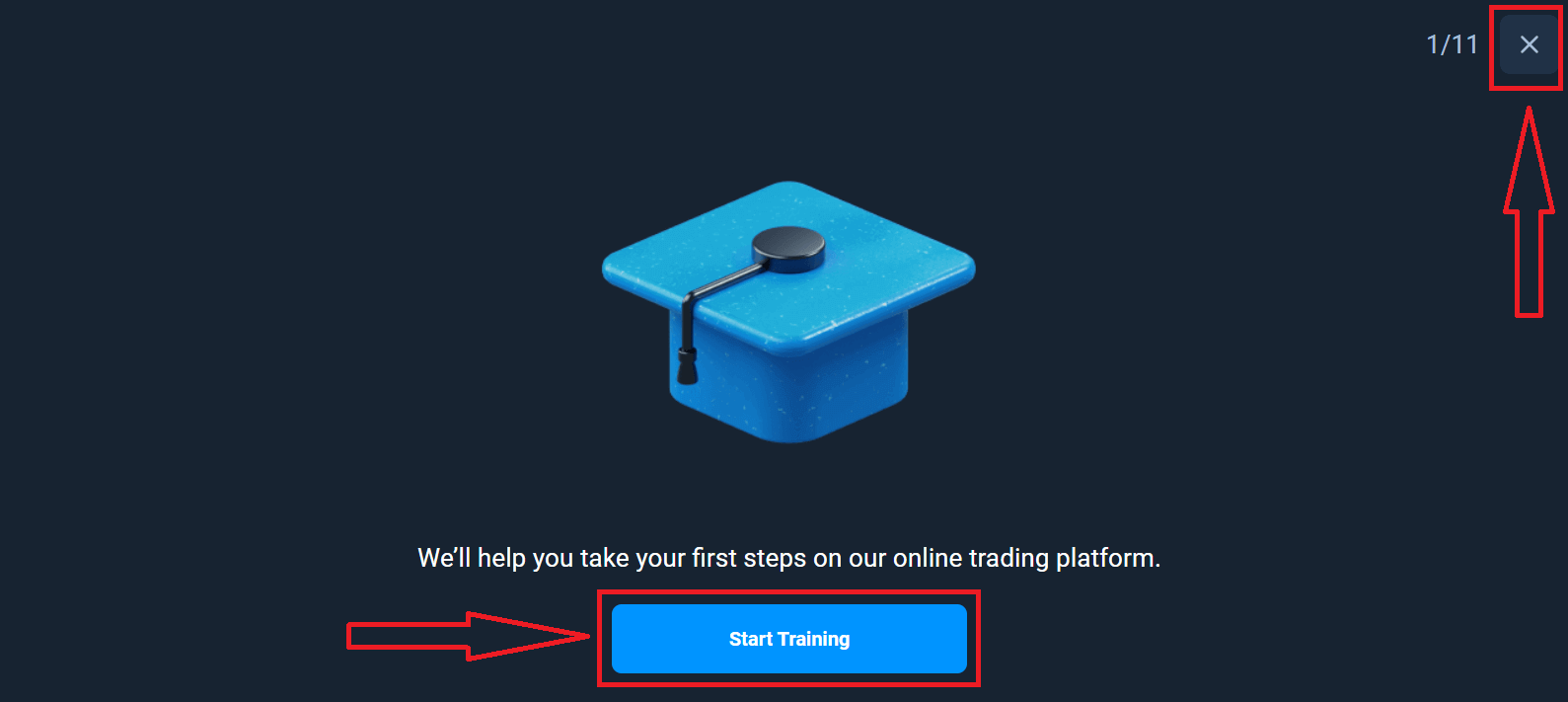

Congratulation! You have registered successfully. Firstly, We’ll help you take your first steps on our online trading platform, click "Start Training" to take a quick view of Olymptrade, If you know how to use Olymptrade, click "X" in upper right corner.

Now you are able to start trading, you have $10,000 in Demo account. A Demo account is a tool for you to get familiar with the platform, practice your trading skills on different assets and try out new mechanics on a real-time chart without risks.

You can also trade on a real account after depositing by clicking on the live account that you want to top up (in the "Accounts" menu),

Pick the "Deposit" option, and then choose the amount and the method of payment.

To start Live trading you have to make an investment in your account (The minimum deposit amount is 10 USD/EUR).

How to make a Deposit in Olymptrade

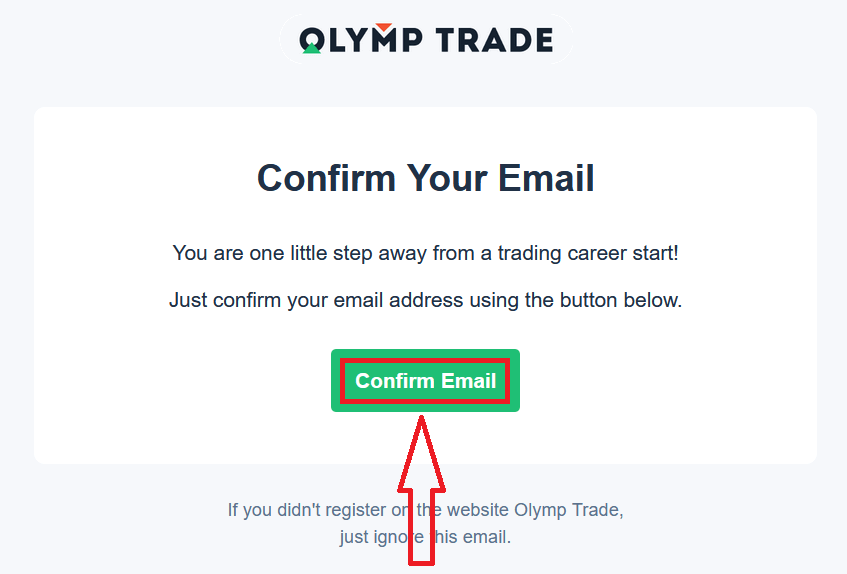

Finally, you access your email, Olymptrade will send you a confirmation mail. Click "Confirm Email" button in that mail to activate your account. So, you will finish registering and activating your account.

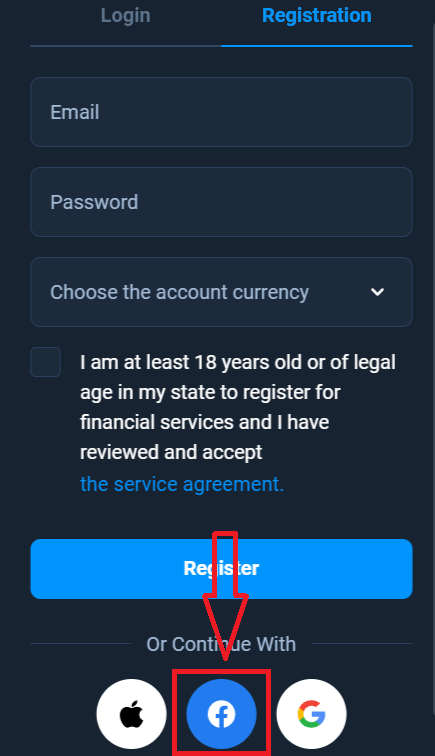

How to Register with a Facebook account

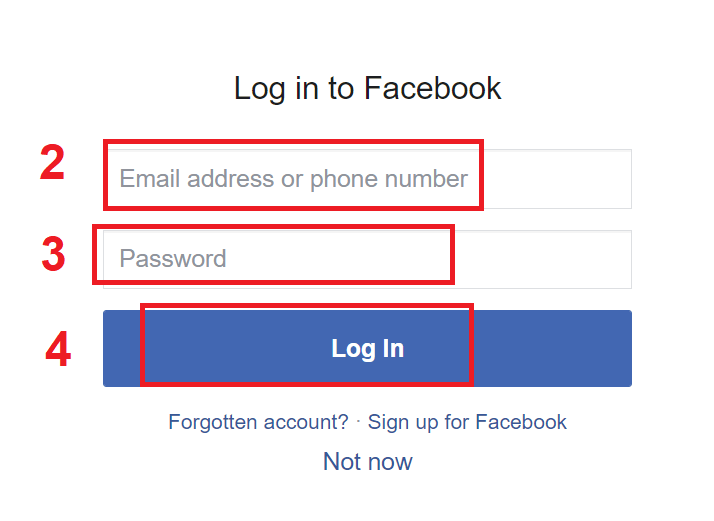

Also, you have an option to open your account by Facebook account and you can do that in just few simple steps:1. Click on Facebook button

2. Facebook login window will be opened, where you will need to enter your email address that you used to register in Facebook

3. Enter the password from your Facebook account

4. Click on “Log In”

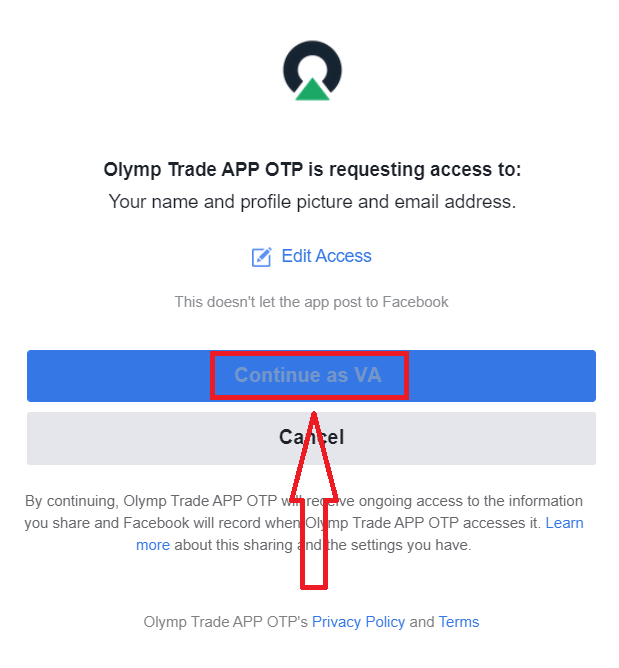

Once you’ve clicked on the “Log in” button, Olymptrade is requesting access to: Your name and profile picture and email address. Click Continue...

After that you will be automatically redirected to the Olymptrade platform.

How to Register with a Google account

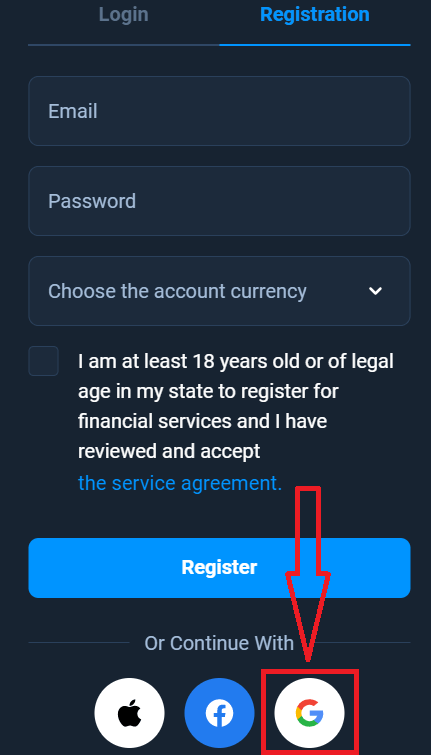

1. To sign up with a Google account, click on the corresponding button in the registration form.

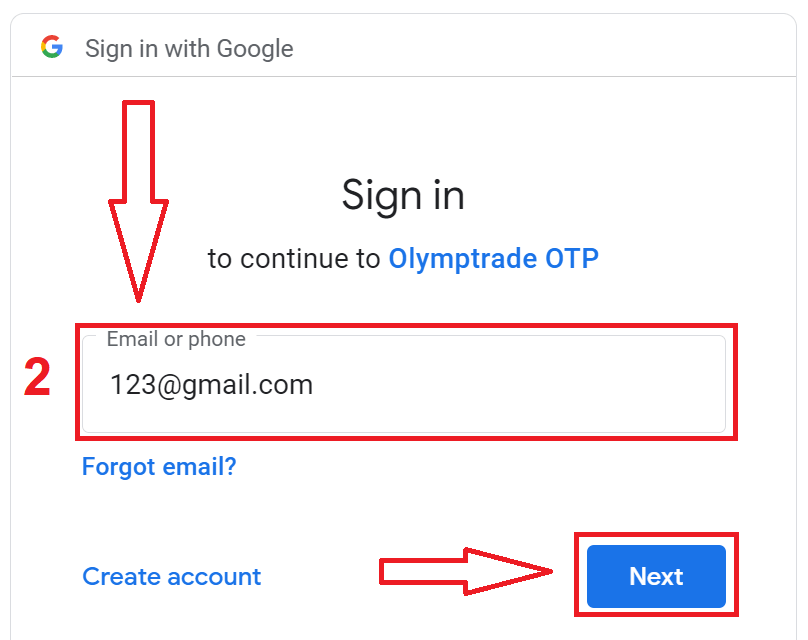

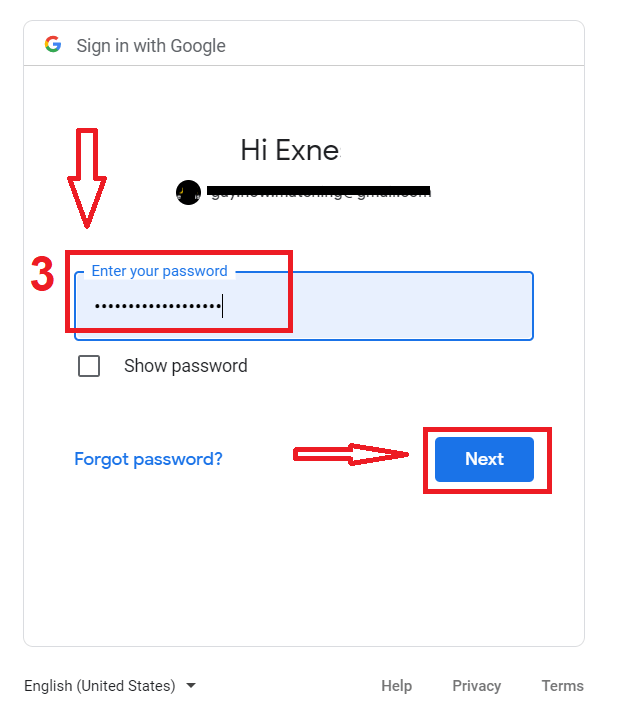

2. In the newly opened window enter your phone number or email and click "Next".

3. Then enter the password for your Google account and click “Next”.

After that, follow the instructions sent from the service to your email address.

How to Register with a Apple ID

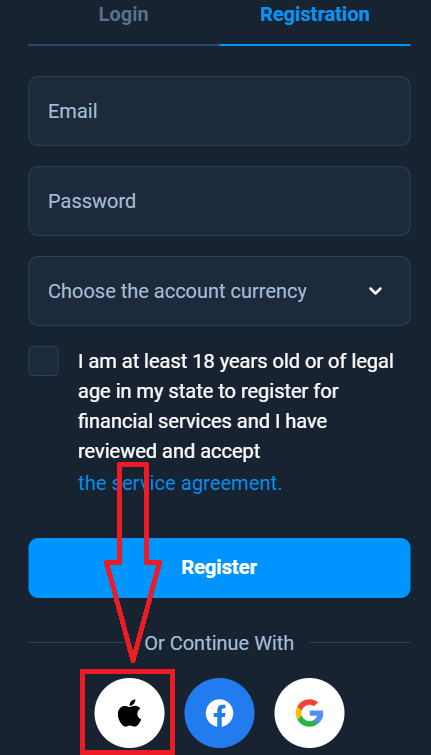

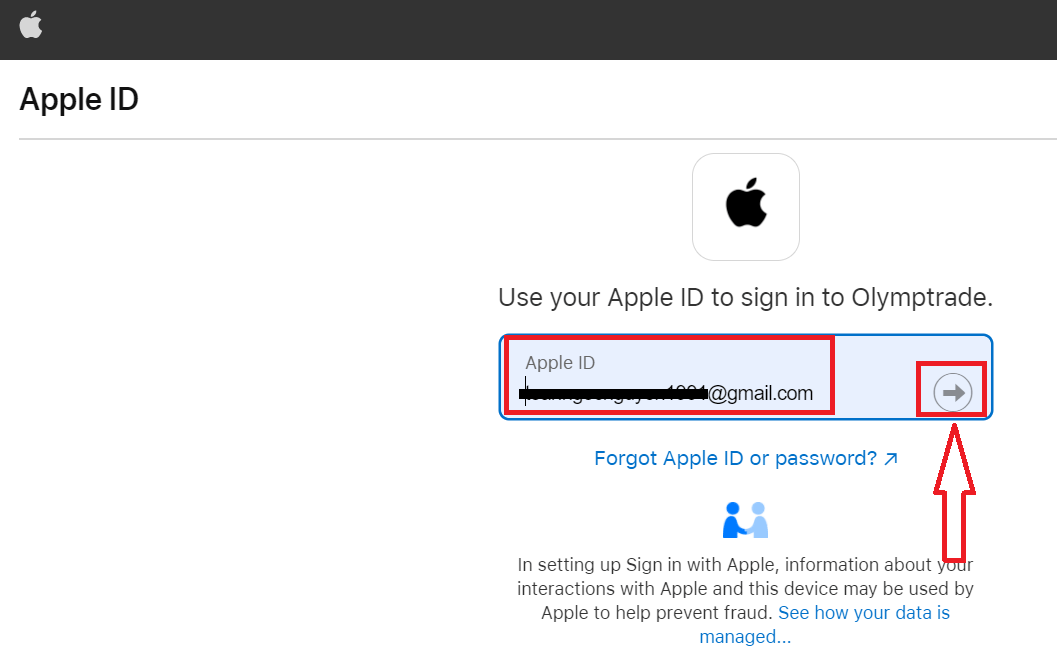

1. To sign up with a Apple ID, click on the corresponding button in the registration form.

2. In the newly opened window enter your Apple ID and click "Next".

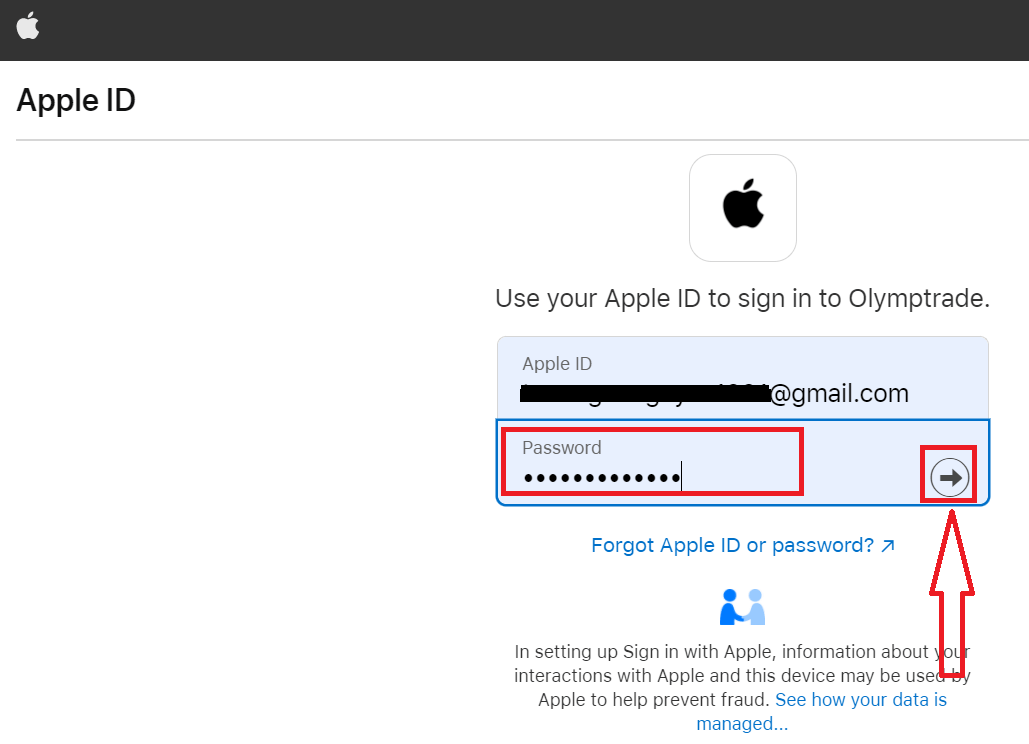

3. Then enter the password for your Apple ID and click “Next”.

After that, follow the instructions sent from the service and you can start trading with Olymptrade

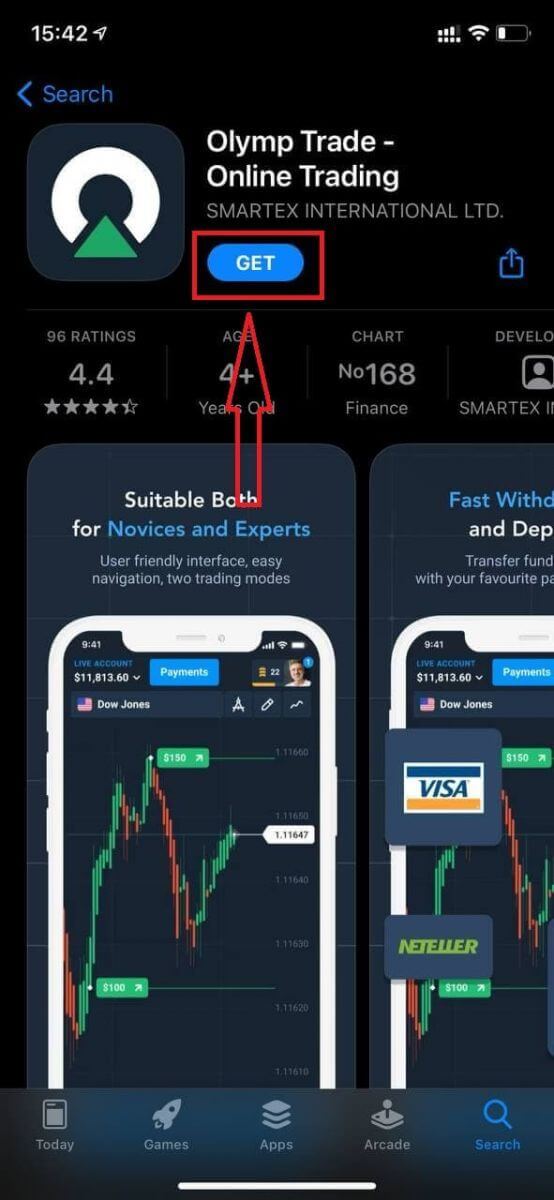

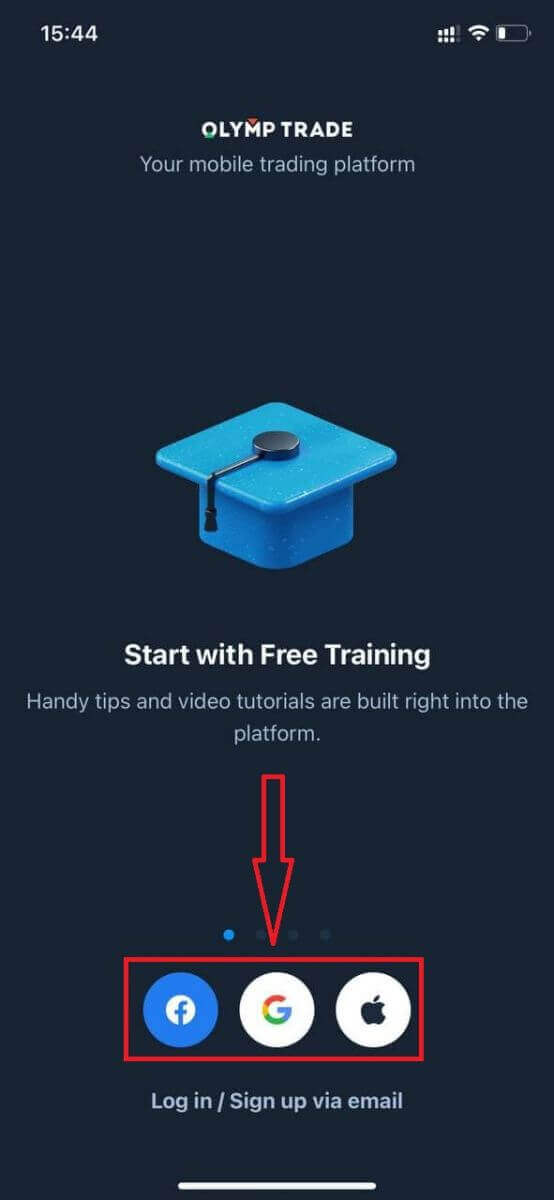

Register on Olymptrade iOS App

If you have an iOS mobile device you will need to download the official Olymptrade mobile app from App Store or here. Simply search for “Olymptrade - Online Trading” app and download it on your iPhone or iPad.The mobile version of the trading platform is exactly the same as web version of it. Consequently, there won’t be any problems with trading and transferring funds. Moreover, Olymptrade trading app for iOS is considered to be the best app for online trading. Thus, it has a high rating in the store.

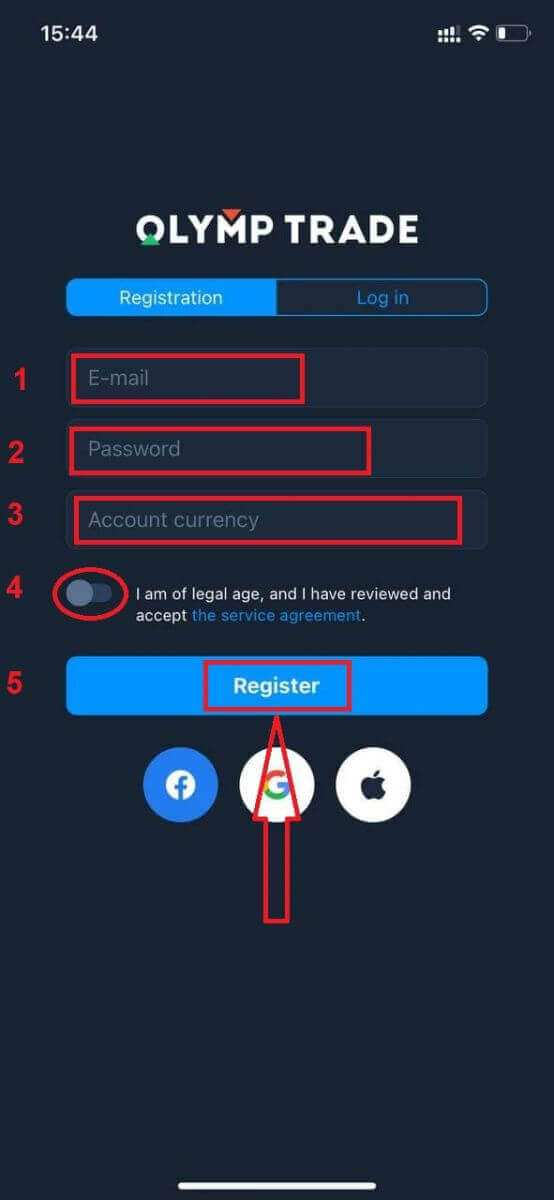

Now you can sign up via email.

Registration for the iOS mobile platform is also available for you.

- Enter a valid email address.

- Create a strong password.

- Choose the account currency (EUR or USD)

- You also need to agree to the service agreement and confirm that you are of legal age (over 18).

- Click "Register" button.

Congratulation! You have registered successfully. Now you have $10,000 in Demo Account.

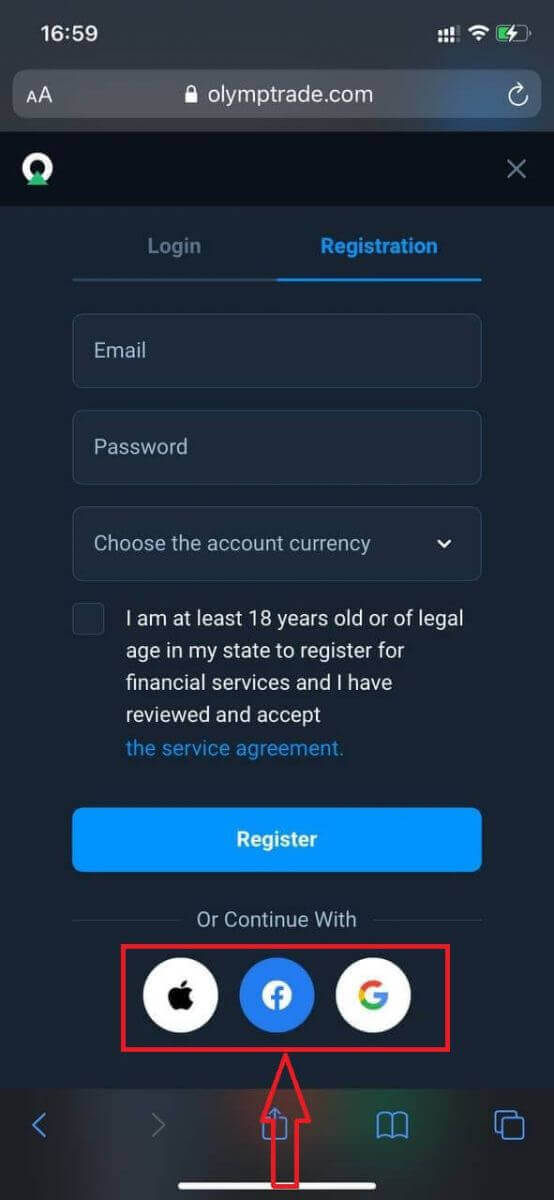

In case of social registration click on “Apple” or “Facebook” or “Google”.

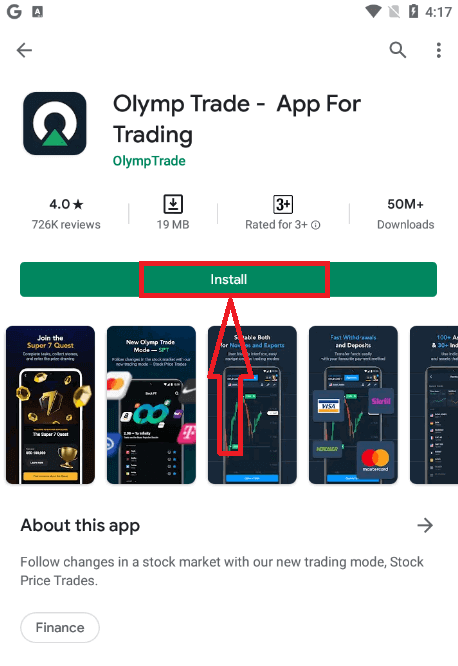

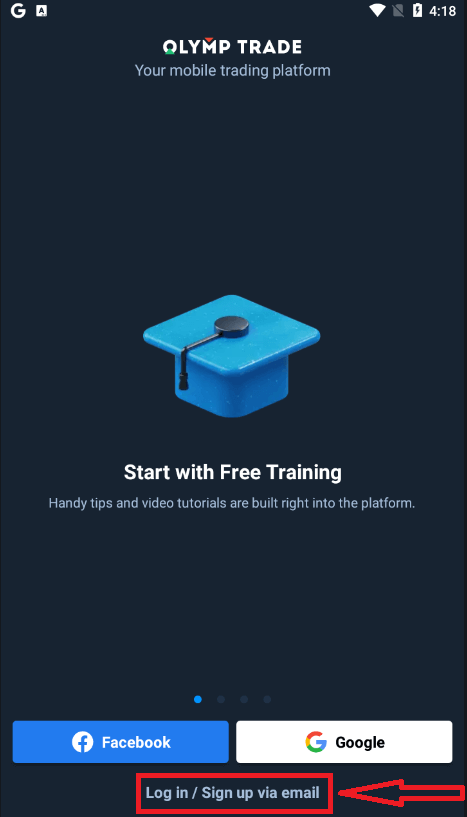

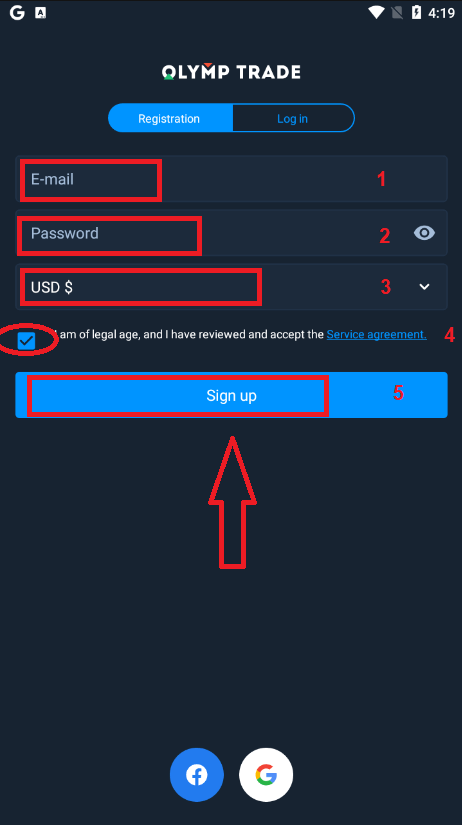

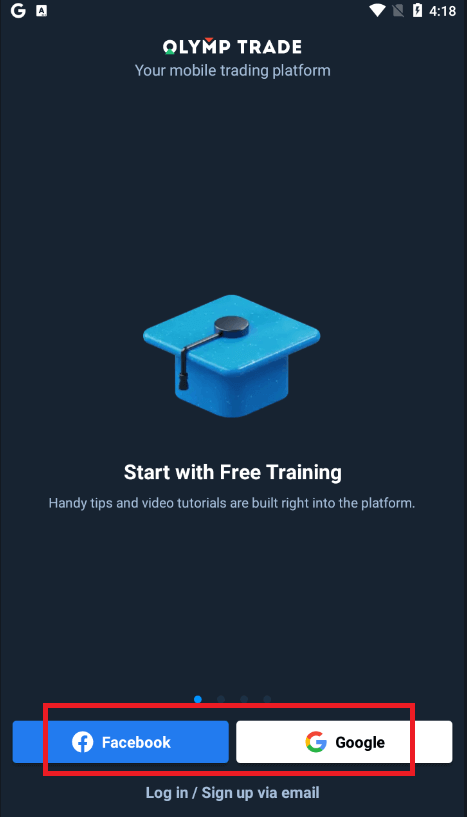

Register on Olymptrade Android App

If you have an Android mobile device you will need to download the official Olymptrade mobile app from Google Play or here. Simply search for “Olymptrade - App For Trading” app and download it on your device.The mobile version of the trading platform is exactly the same as web version of it. Consequently, there won’t be any problems with trading and transferring funds. Moreover, Olymptrade trading app for Android is considered to be the best app for online trading. Thus, it has a high rating in the store.

Now you can sign up via email.

Registration for the Android mobile platform is also available for you.

- Enter a valid email address.

- Create a strong password.

- Choose the account currency (EUR or USD)

- You also need to agree to the service agreement and confirm that you are of legal age (over 18).

- Click "Sign up" button.

Congratulation! You have registered successfully. Now you have $10,000 in Demo Account.

In case of social registration click on “Facebook” or “Google”.

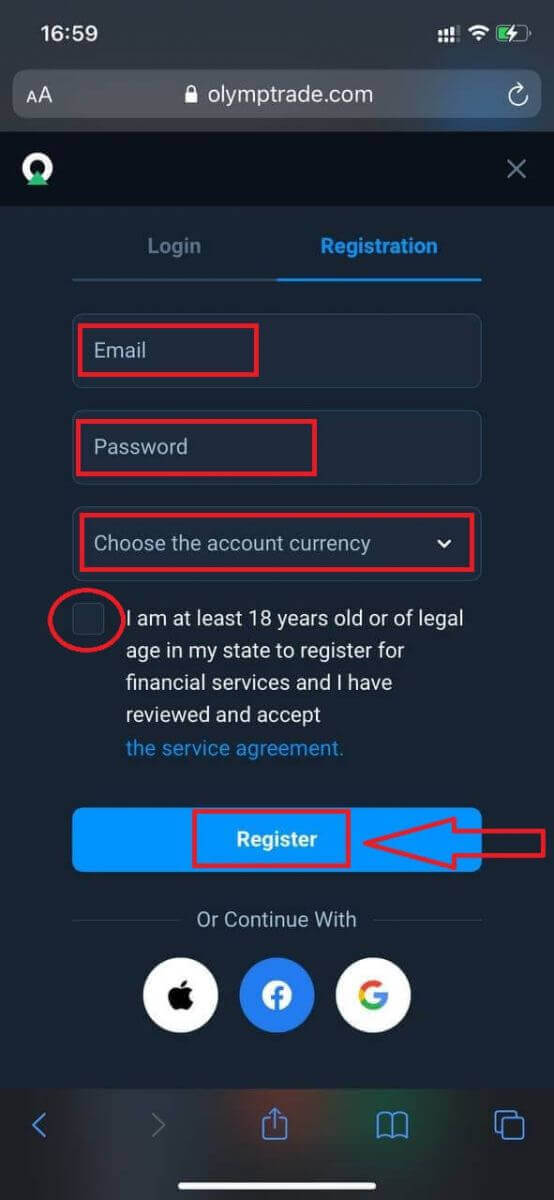

Register Olymptrade account on Mobile Web Version

If you want to trade on the mobile web version of Olymptrade trading platform, you can easily do it. Initially, open up your browser on your mobile device. After that, search for “olymptrade.com” and visit the official website of the broker.Click "Registration" button in the upper right corner.

At this step we still enter the data: email, password, check "Service Agreement" and click "Register" button.

Here you are! Now you will be able to trade from the mobile web version of the platform. The mobile web version of the trading platform is exactly the same as a regular web version of it. Consequently, there won’t be any problems with trading and transferring funds.

You have $10,000 in Demo Account.

In case of social registration click on “Apple” or “Facebook” or “Google”.

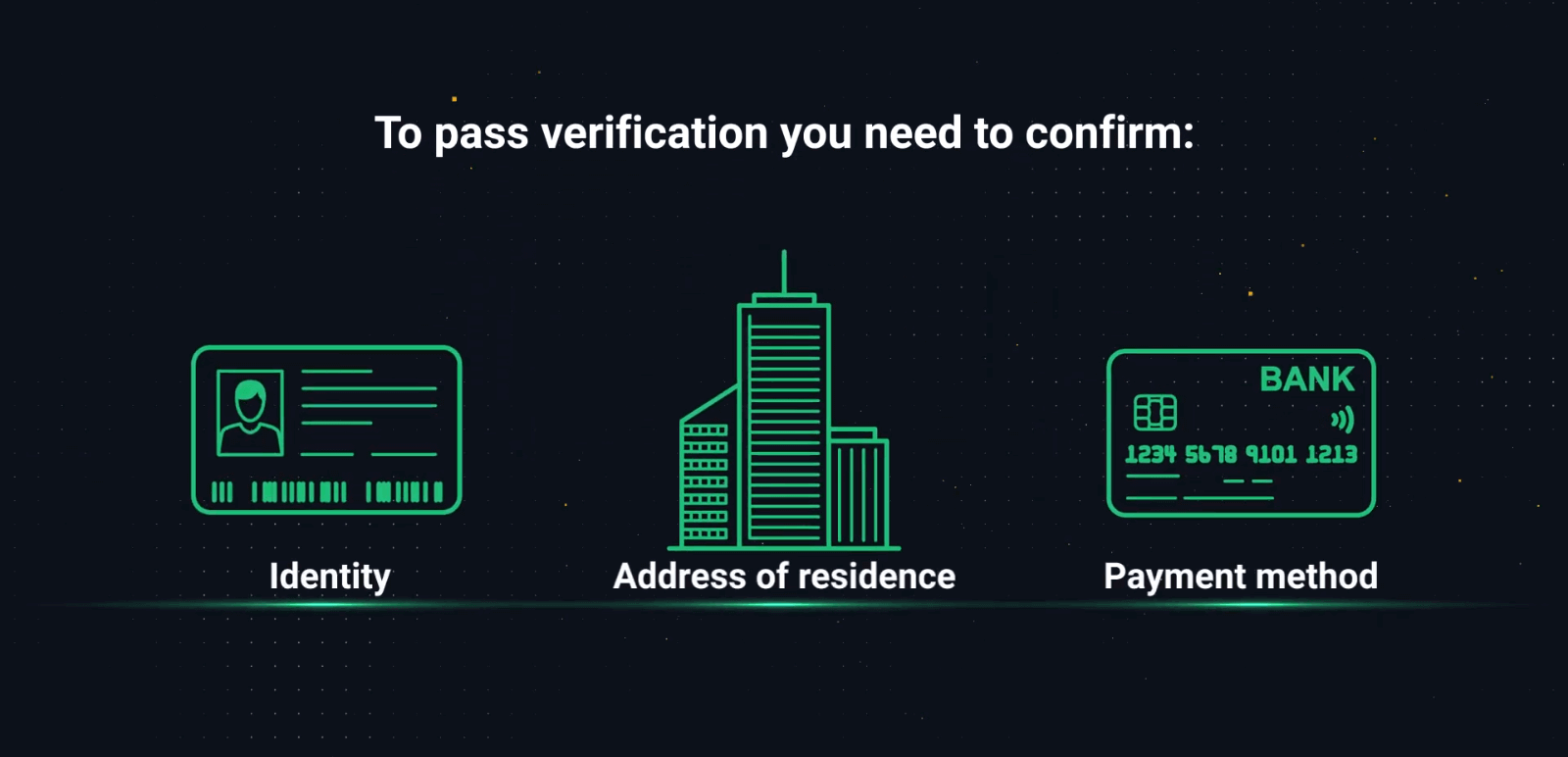

How to Verify Account in Olymptrade

What is mandatory verification?

Verification becomes mandatory when you receive an automated verification request from our system. It may be requested at any moment after registration. The process is a standard procedure among the majority of reliable brokers and is dictated by regulatory requirements.The aim of the verification process is to ensure the security of your account and transactions as well as meet anti-money laundering and Know Your Customer requirements.

Please note that you will have 14 days from the date of the verification request to complete the process.

To verify your account, you will need to upload proof of identity (POI), a 3-D selfie, proof of address (POA), and proof of payment (POP). We will be able to start your verification process only after you provide us with all the documents.

How do I complete mandatory verification?

To verify your account, you will need to upload proof of identity (POI), a 3-D selfie, proof of address (POA), and proof of payment. We will be able to start your verification process only after you provide us with all the documents.Please note that you will have 14 days from the date of the verification request to complete the process.

Please log-in to your Olymptrade account, go to the Verification section, and follow several simple steps of verification process.

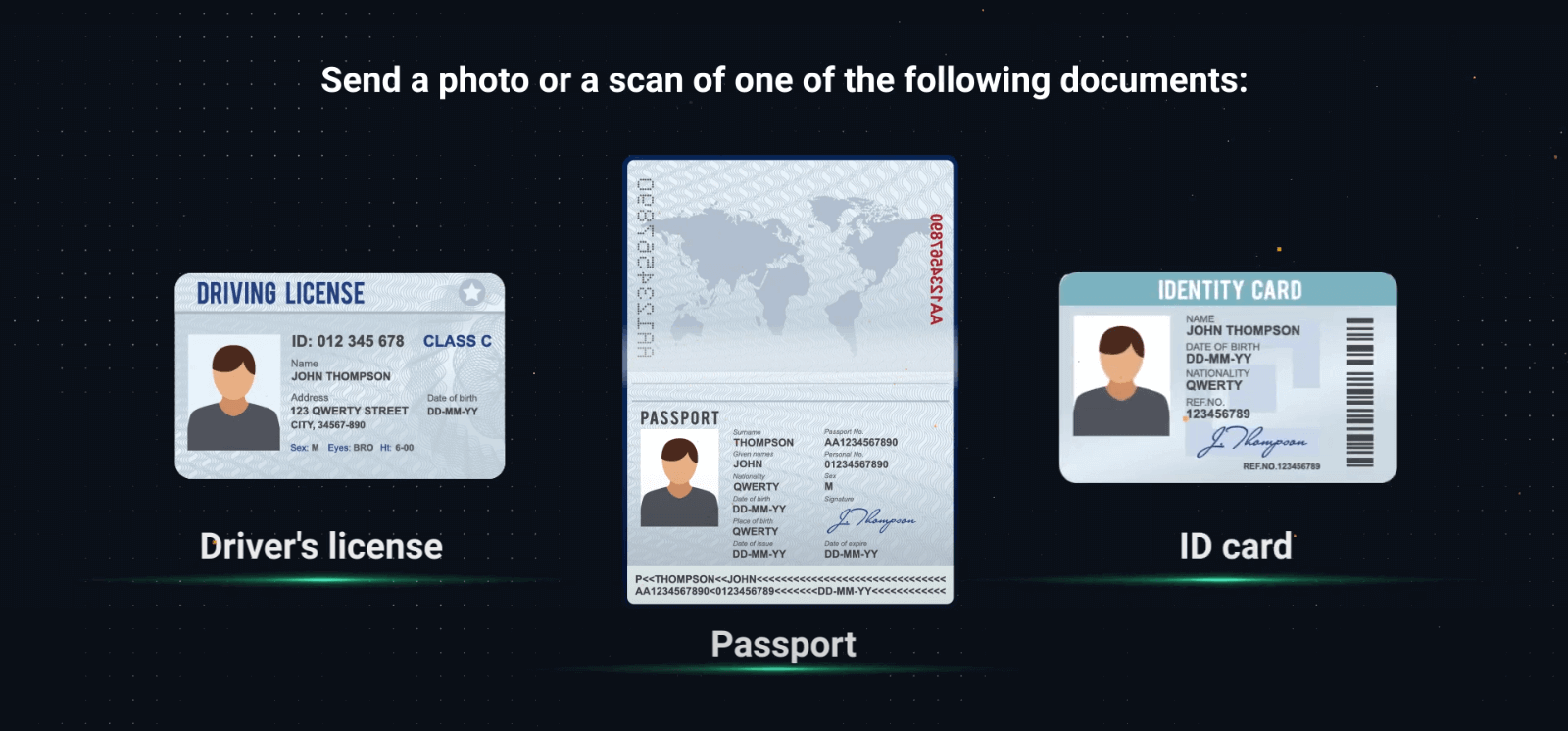

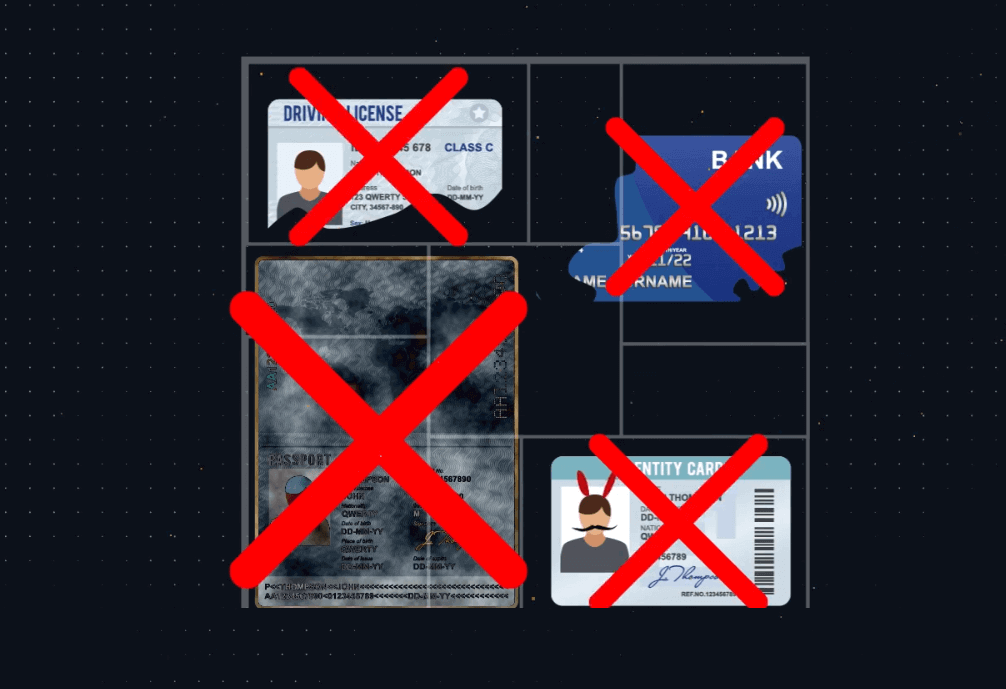

Step 1. Proof of identity

Your POI should be an official document that contains your full name, date of birth, and a clear photograph. A colored scan or photo of your passport or ID is the preferred proof of identity, but you can use a driving license as well.

– When uploading the documents, please check if all the information is visible, in focus, and in color.

– The photo or scan should not have been taken more than 2 weeks ago.

– Screenshots of the documents are not accepted.

– You can provide more than one document if needed. Please check that all the requirements for the documents’ quality and information are followed.

Valid :

Invalid : We dont accept collages, screenshots, or edited photos

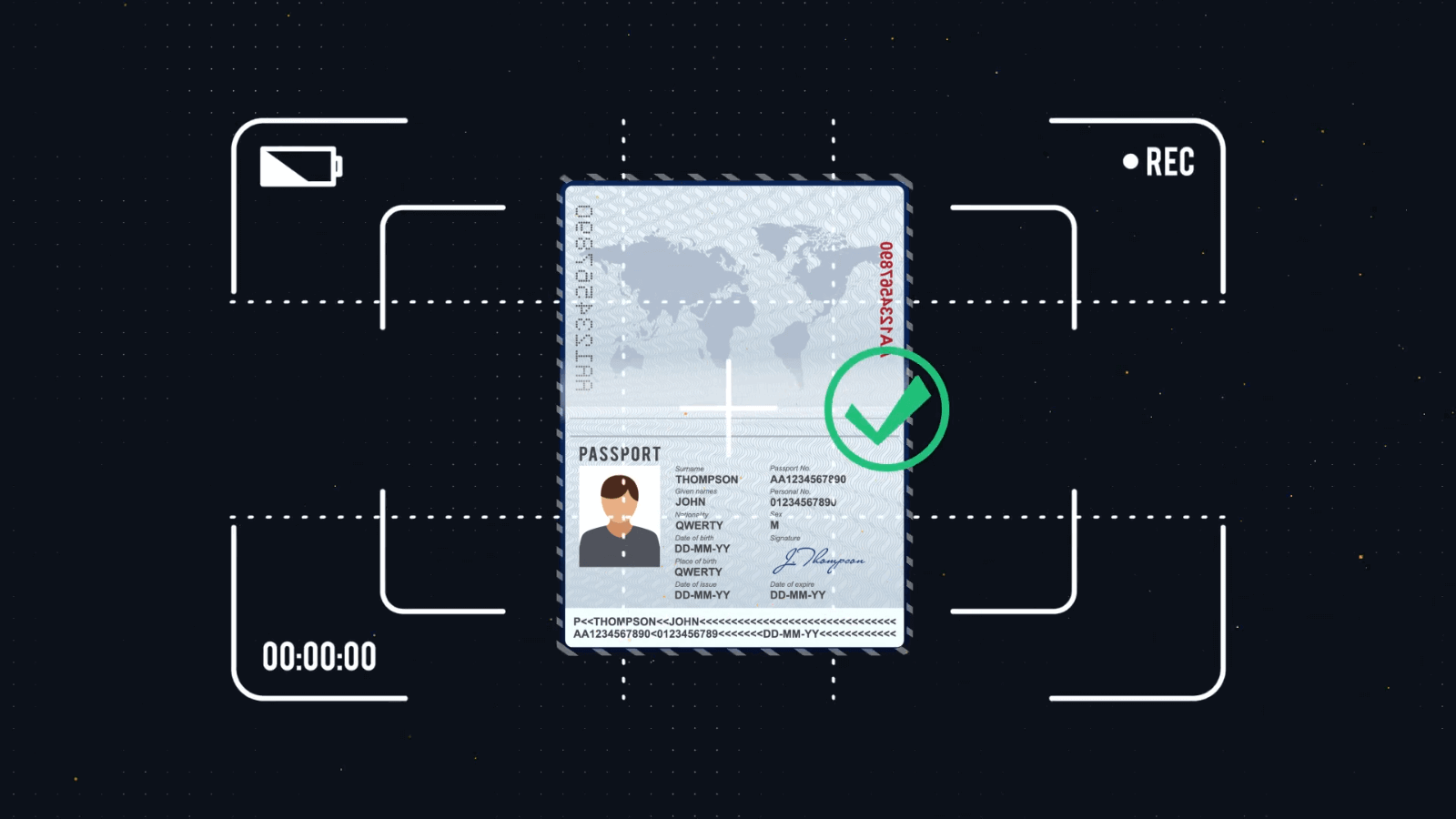

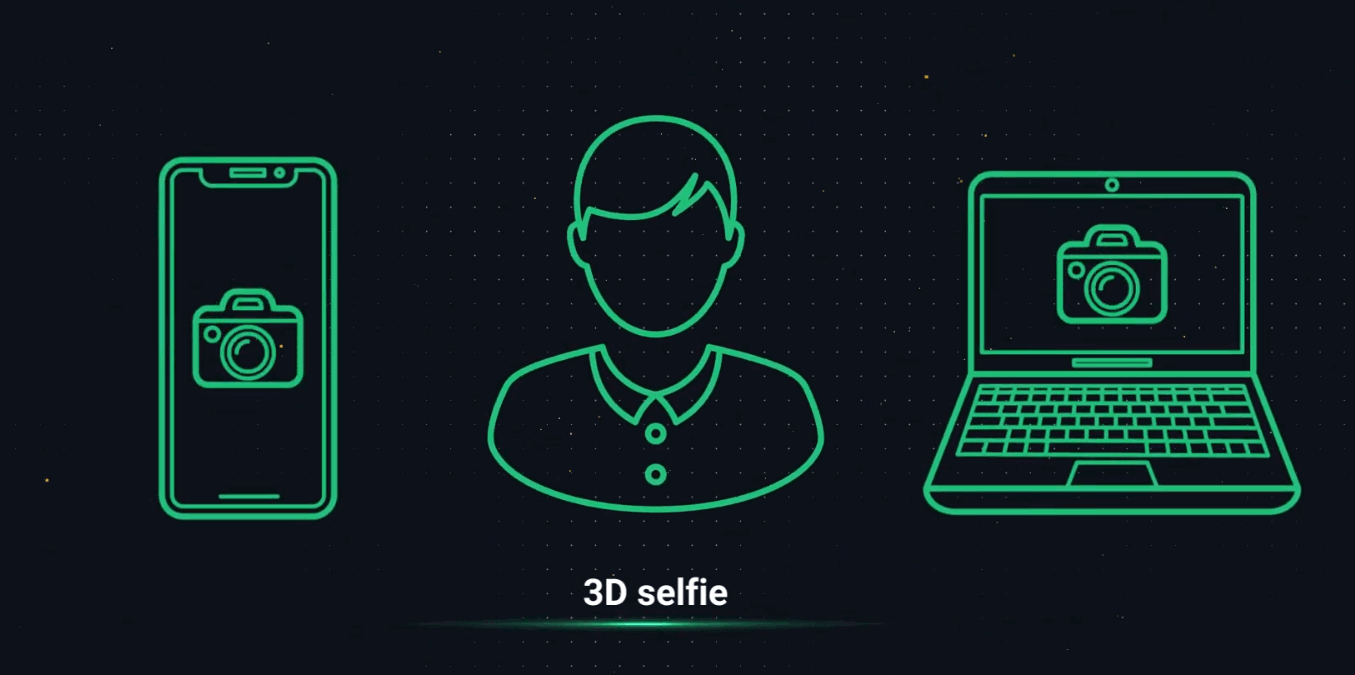

Step 2. 3-D selfie

You will need your camera to take a color 3-D selfie. You will see the detailed instructions on the platform.

If for any reason you don’t have access to the camera on your computer, you can send yourself an SMS and complete the process on your phone. You can also verify your account through the Olymptrade app.

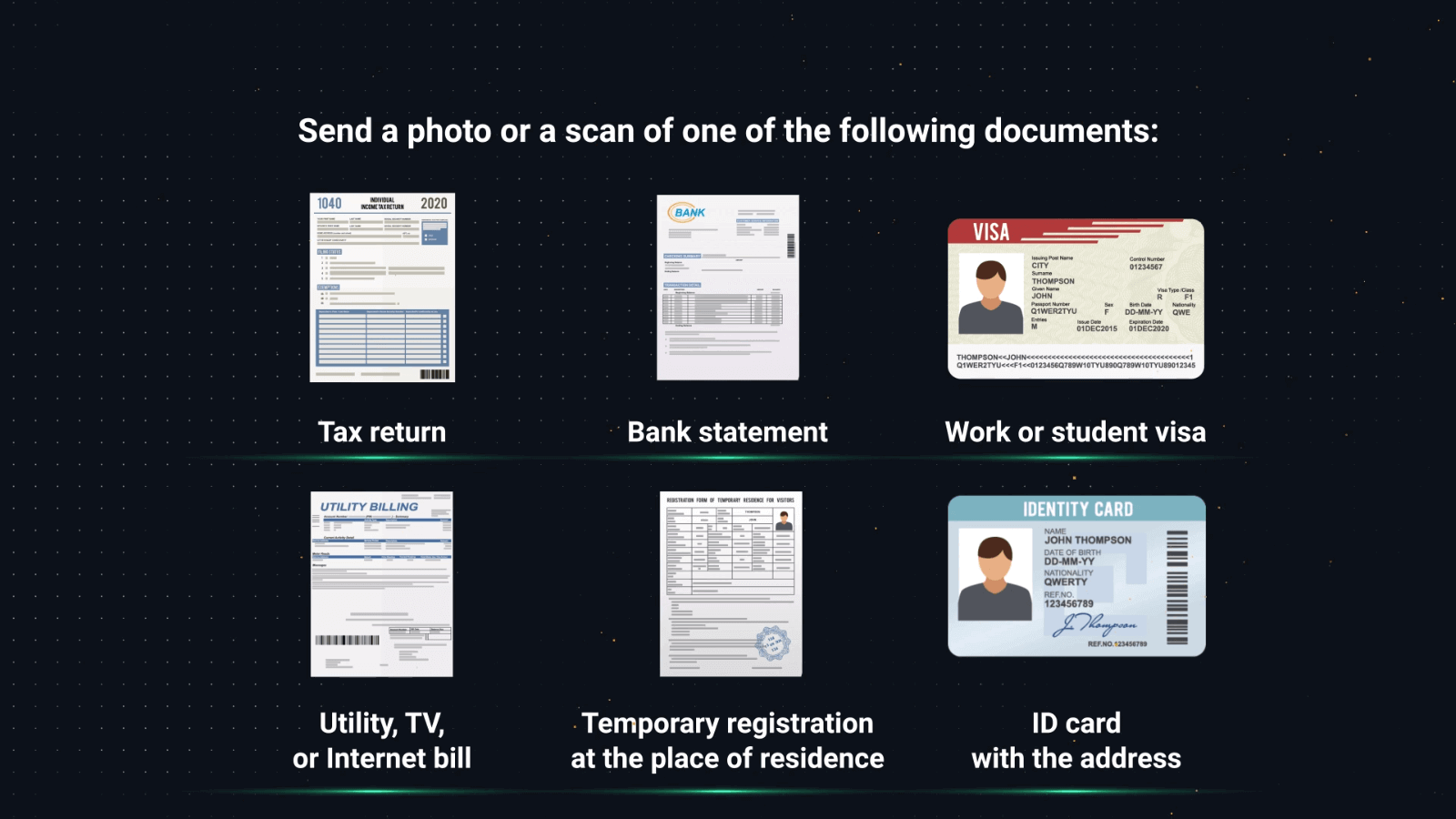

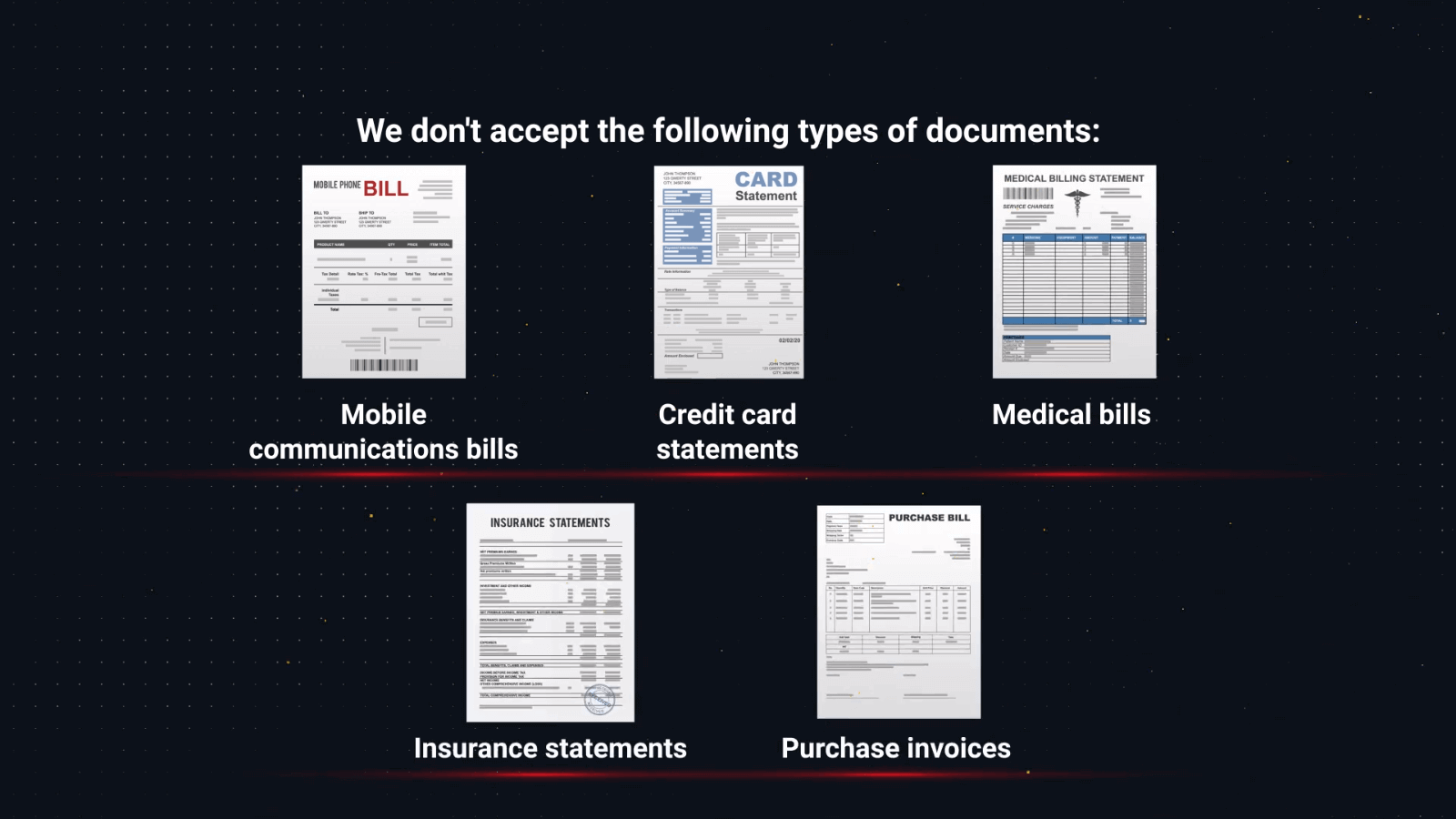

Step 3. Proof of address

Your POA document should contain your full name, address, and issue date, which should not be more than 3 months old.

You can use one of the following documents to verify your address:

– Bank statement (if it contains your address)

– Credit card statement

– Electricity, water, or gas bill

– Phone bill

– Internet bill

– Letter from your local municipality

– Tax letter or bill

Please be aware that mobile phone bills, medical bills, purchase invoices, and insurance statements are not acceptable.

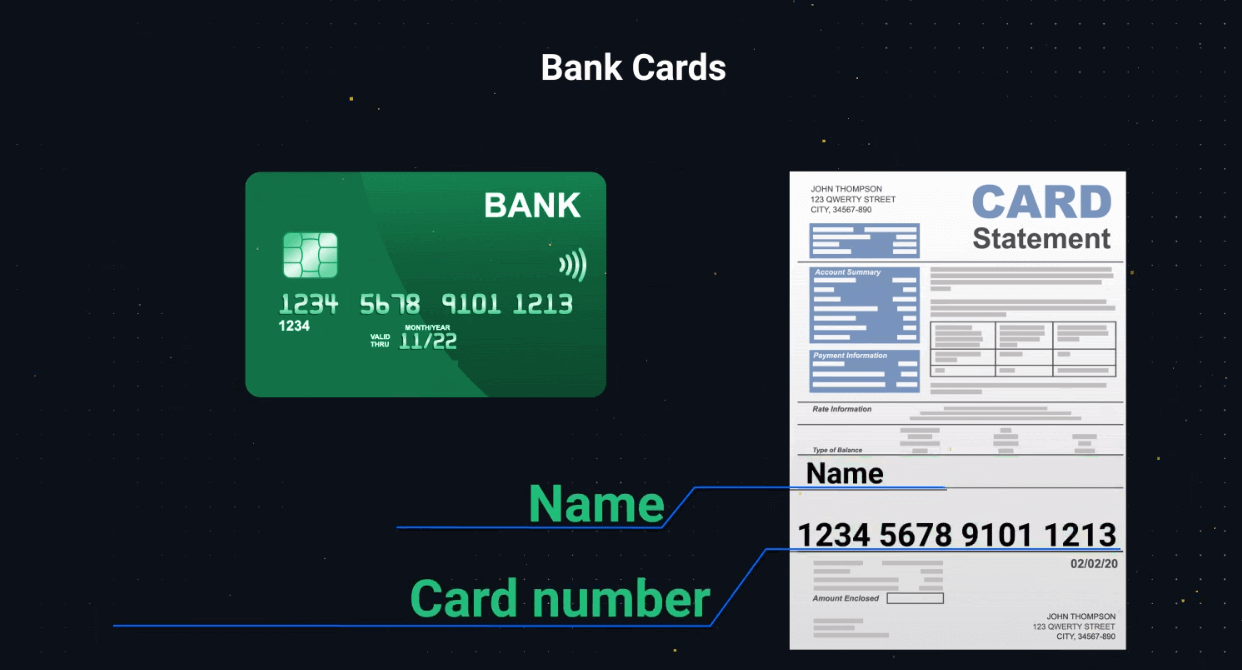

Step 4. Proof of payment

If you deposited via a bank card, your document should contain the front side of your card with your full name, the first 6 and last 4 digits, and the expiration date. The remaining numbers of the card should not be visible in the document.

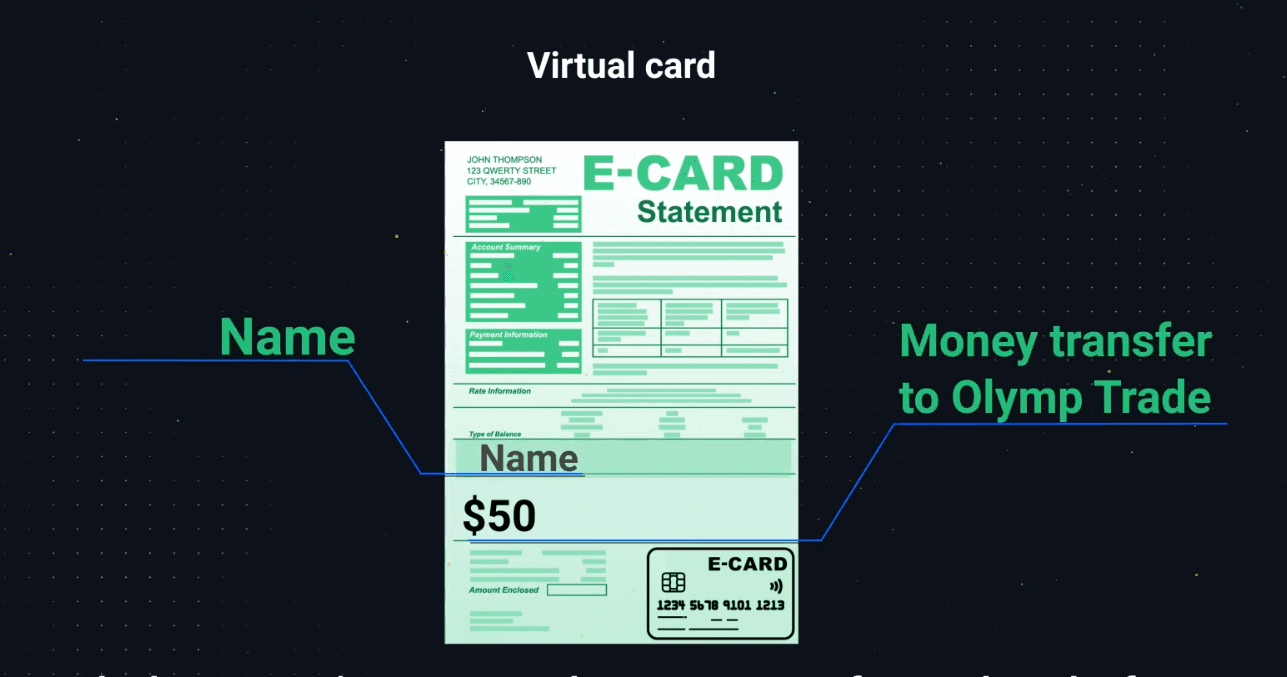

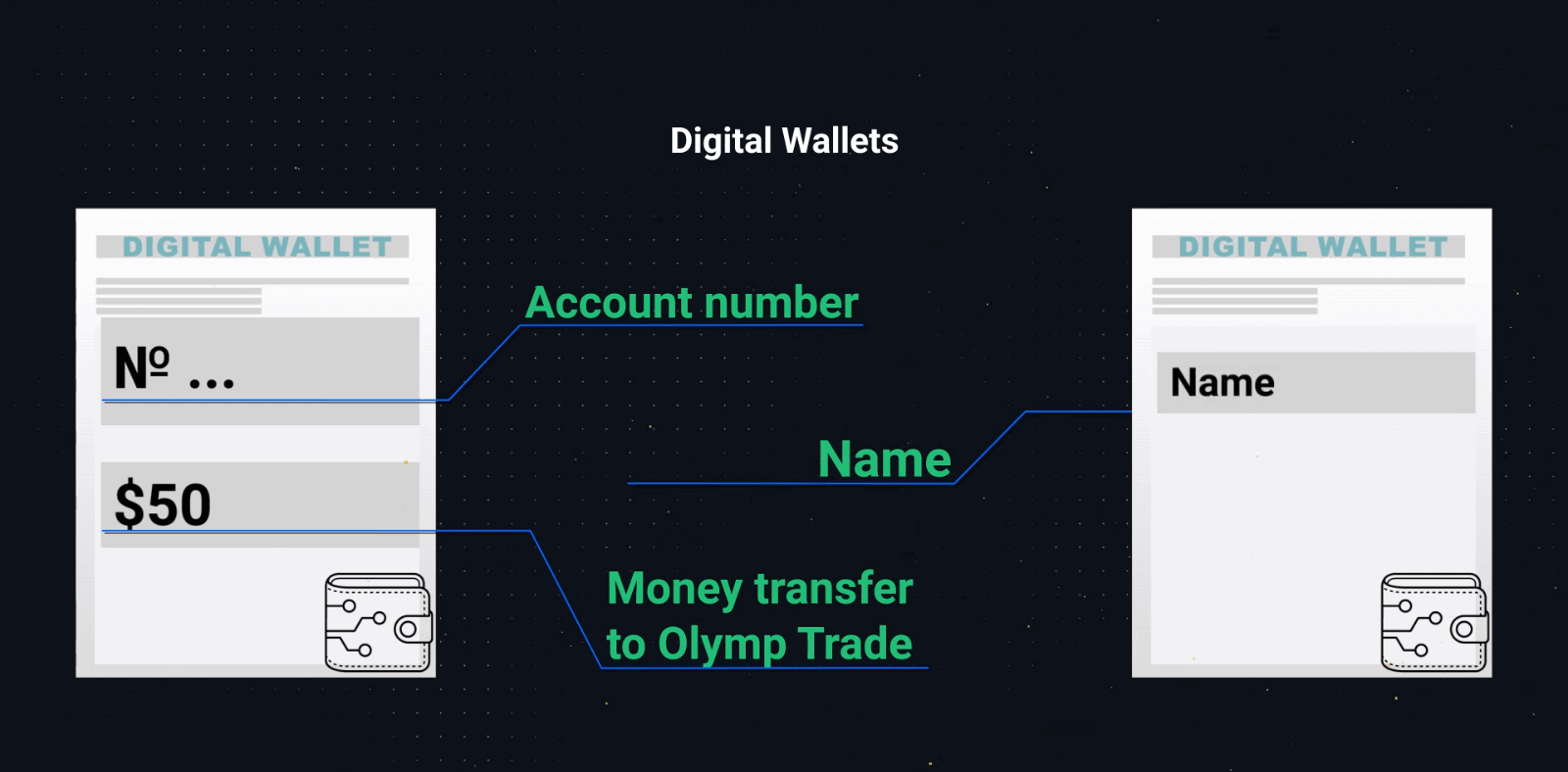

If you deposited via an electronic wallet, you should provide a document that contains the wallet’s number or e-mail address, account holders full name, and the transaction details such as the date and amount.

Before uploading the documents, please check that your e-wallet has been verified by that organization.

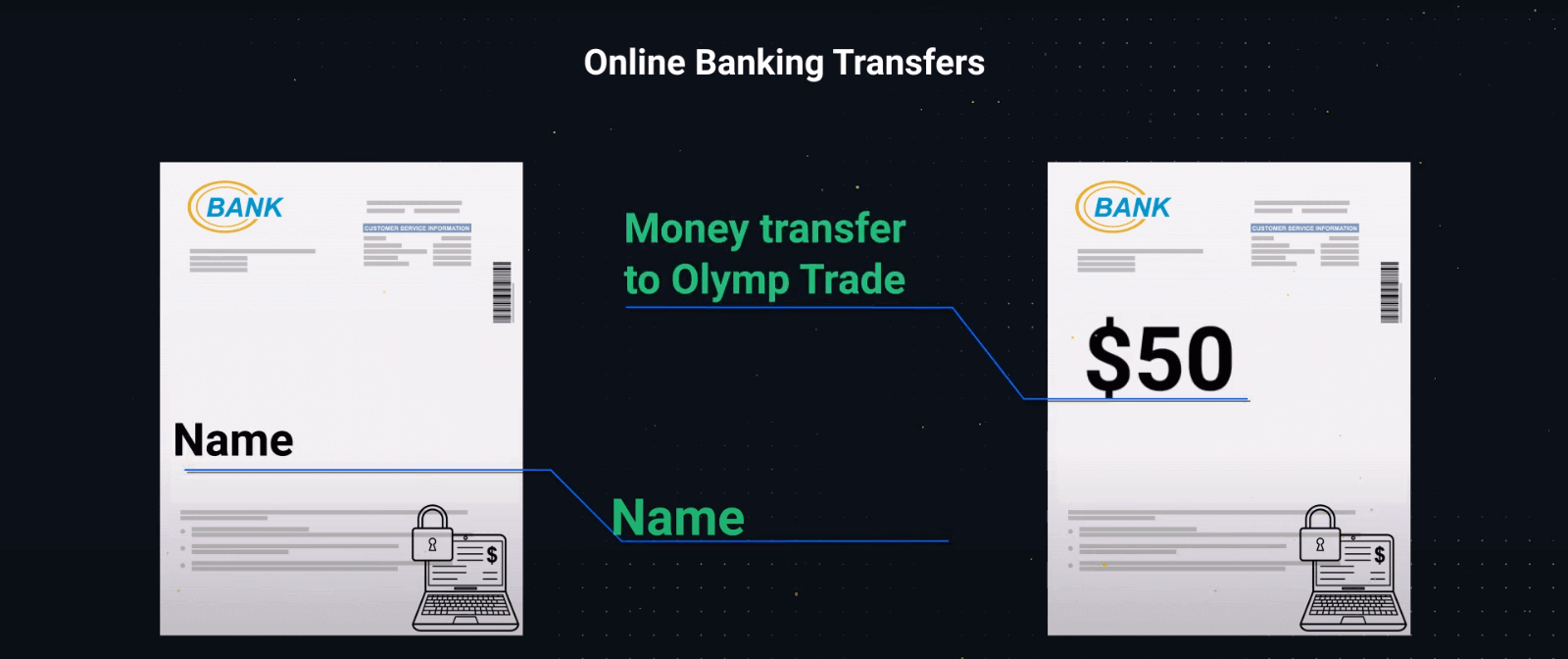

If you deposit money via wire transfer, the following must be visible: bank account number, account holders first and last name, and the transaction details such as the date and amount.

– If the owners name, bank number, e-wallet number or e-mail, and transaction to the platform cannot be seen in the same image, please provide two screenshots:

The first one with the owners name and the e-wallet or bank account number.

The second one with an e-wallet or bank account number and transaction to the platform.

– We will gladly accept either a scan or a photo of the documents listed above.

– Please make sure that all the documents are visible, with the edges uncut, and are in focus. Photos or scans should be in color.

When will the mandatory verification be ready?

Once your documents have been uploaded, verification usually takes 24 hours or less. However, in rare cases, the process may take up to 5 working days.You will receive an email or SMS notification regarding your verification status. You can also track the current status of your verification in your profile.

If any additional documents are necessary, we will email you promptly.

All relevant updates on your verification process can be found in the Account Verification section of your profile.

Here is how to get there:

1. Go to the platform.

2. Click on the Profile icon.

3. At the bottom of the page, click on Profile Settings.

4. Click on Account Verification.

5. You will see updated information on your verification status.

How to Deposit Money at Olymptrade

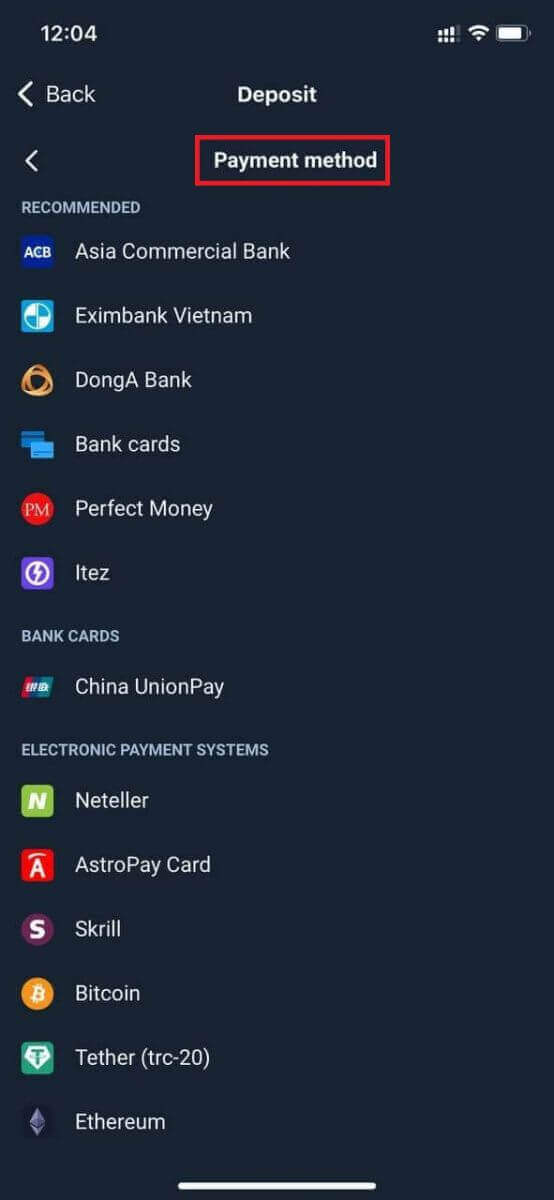

What Payment Methods Can I Use?

There is a unique list of payment methods available for every country. They can be grouped into:

- Bank cards.

- Digital wallets (Neteller, Skrill, etc.).

- Payment invoice generation in banks or special kiosks.

- Local banks (bank transfers).

- Cryptocurrencies.

For example, you can deposit and withdraw your funds from Olymptrade in India using Visa/Mastercard bank cards or by creating a virtual card in the AstroPay system, as well as using e-wallets like Neteller, Skrill, WebMoney, GlobePay. Bitcoin transactions are also good to go.

How do I make A Deposit

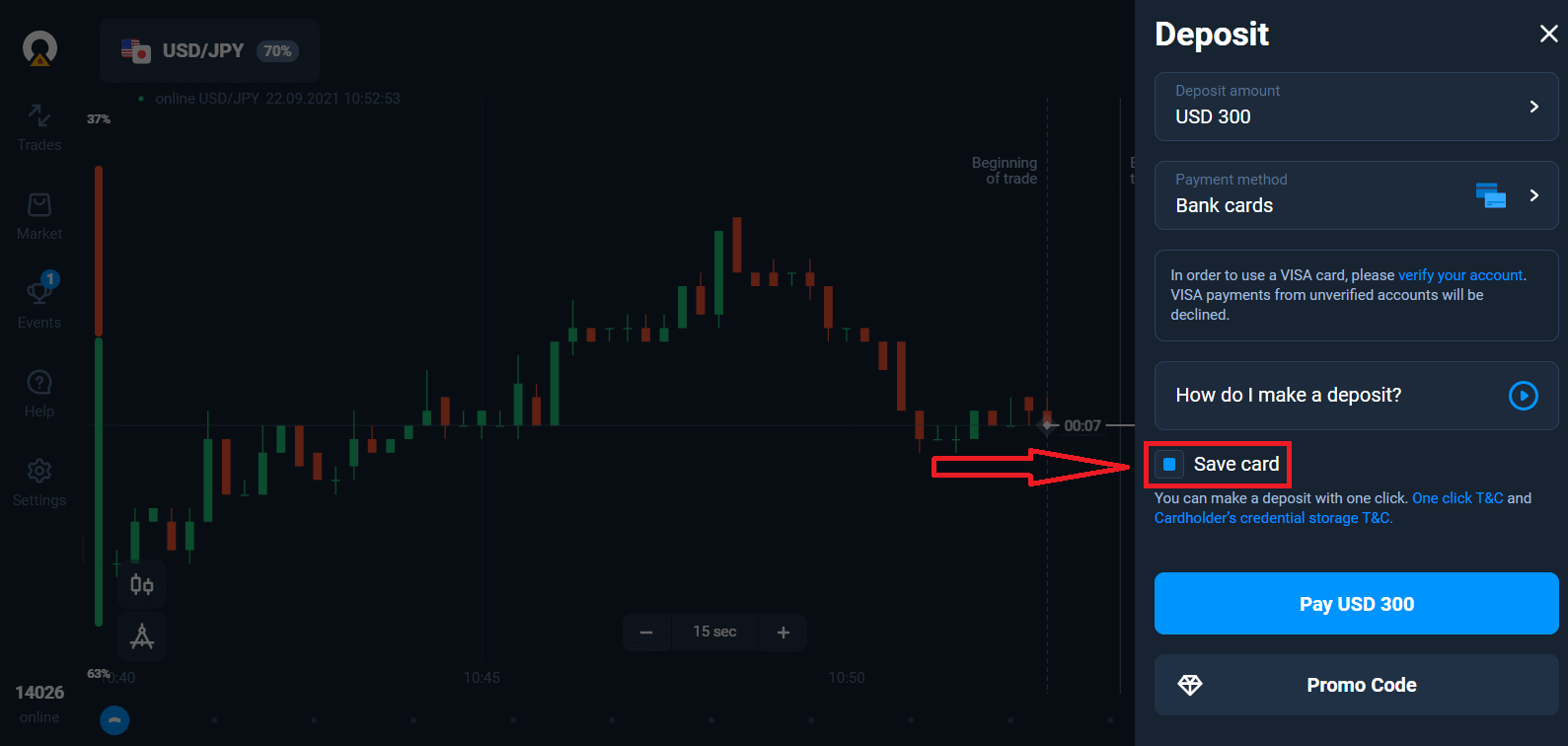

Deposit using Desktop

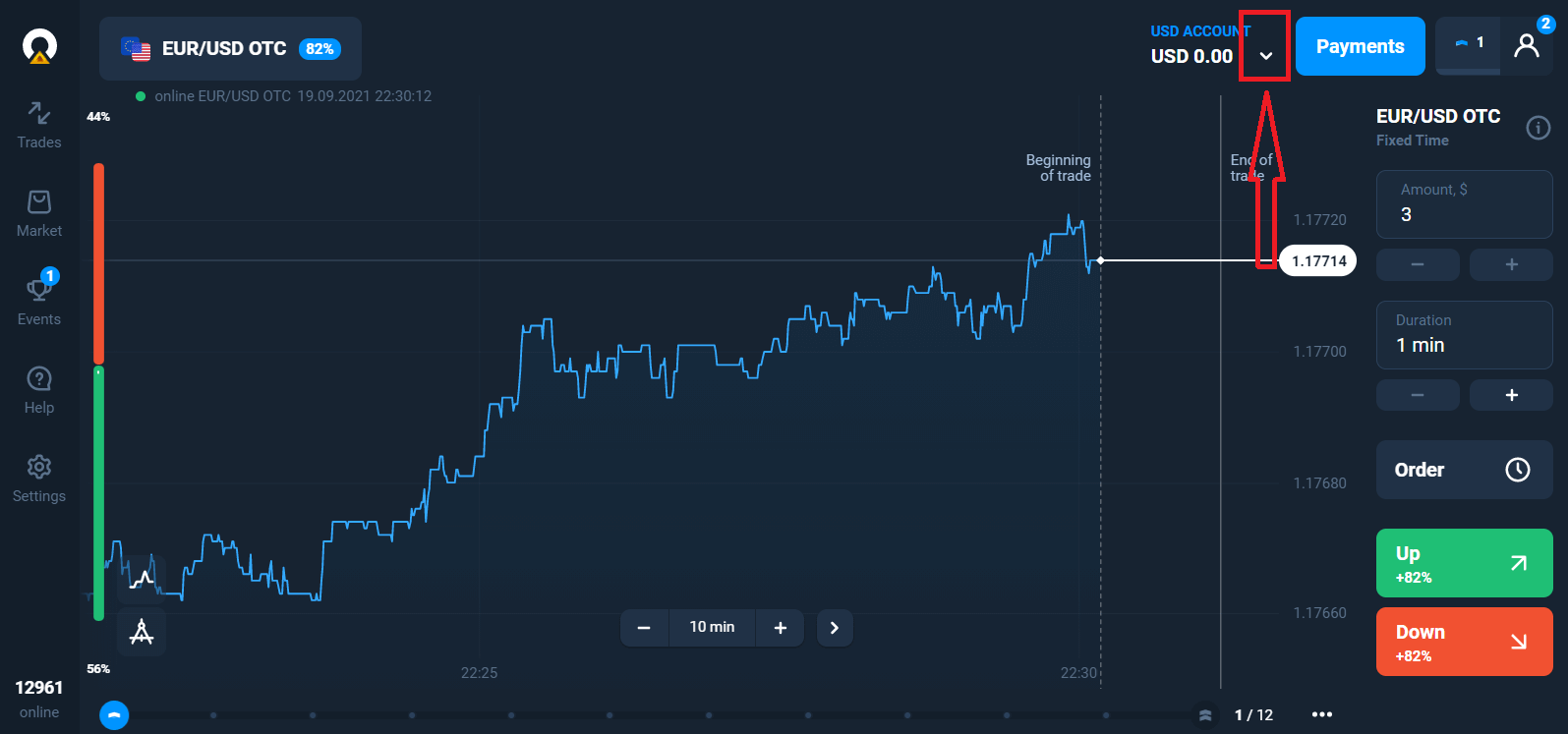

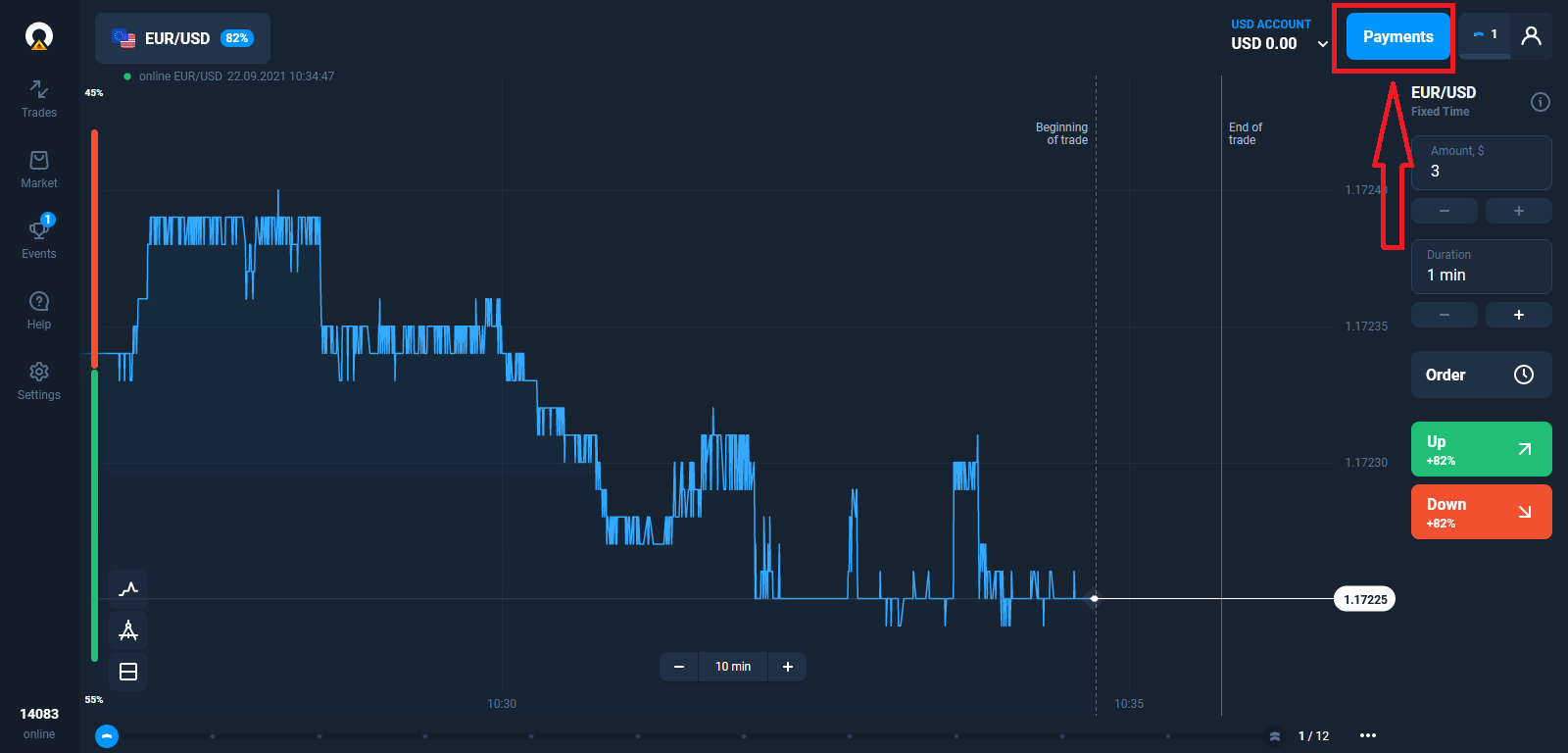

Click "Payments" button.

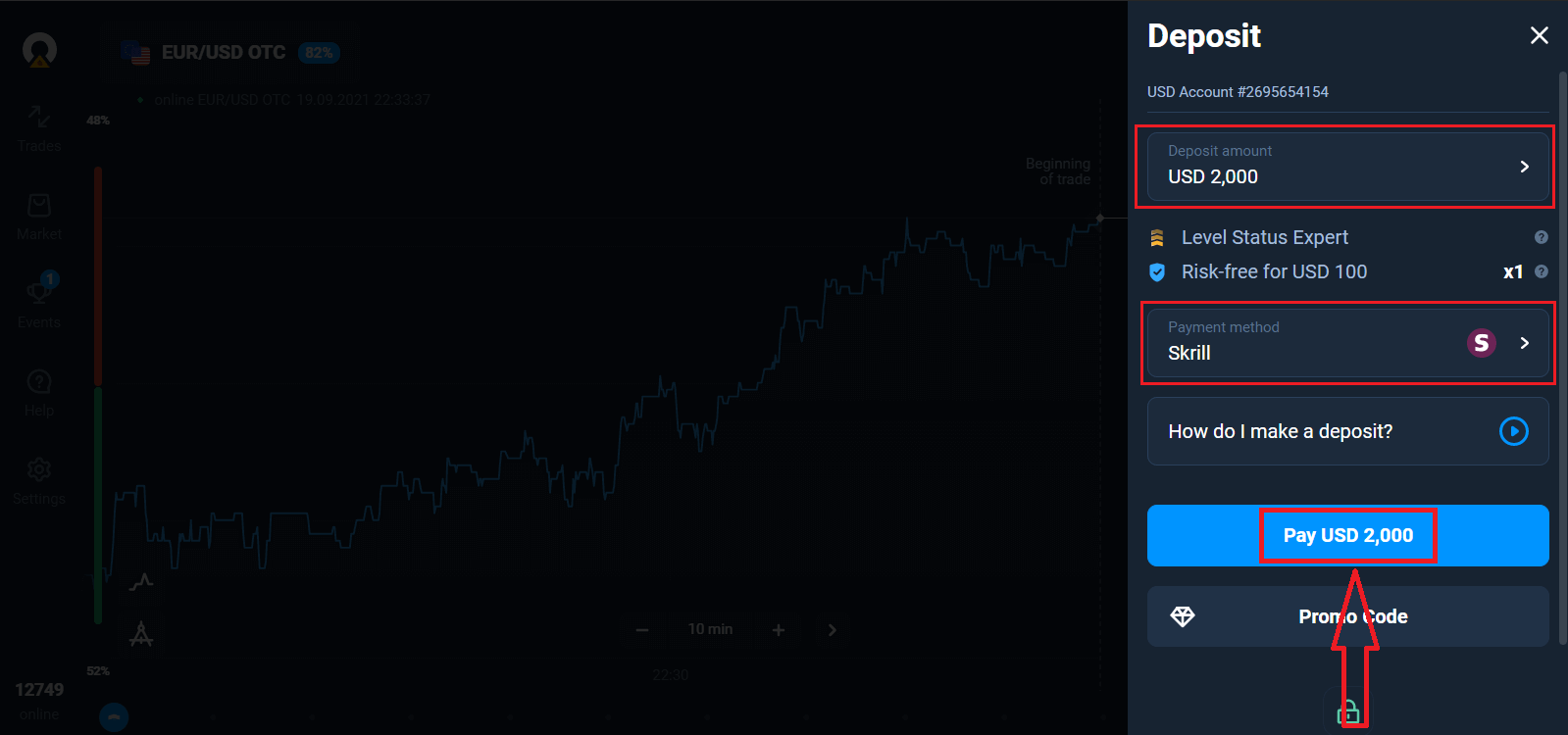

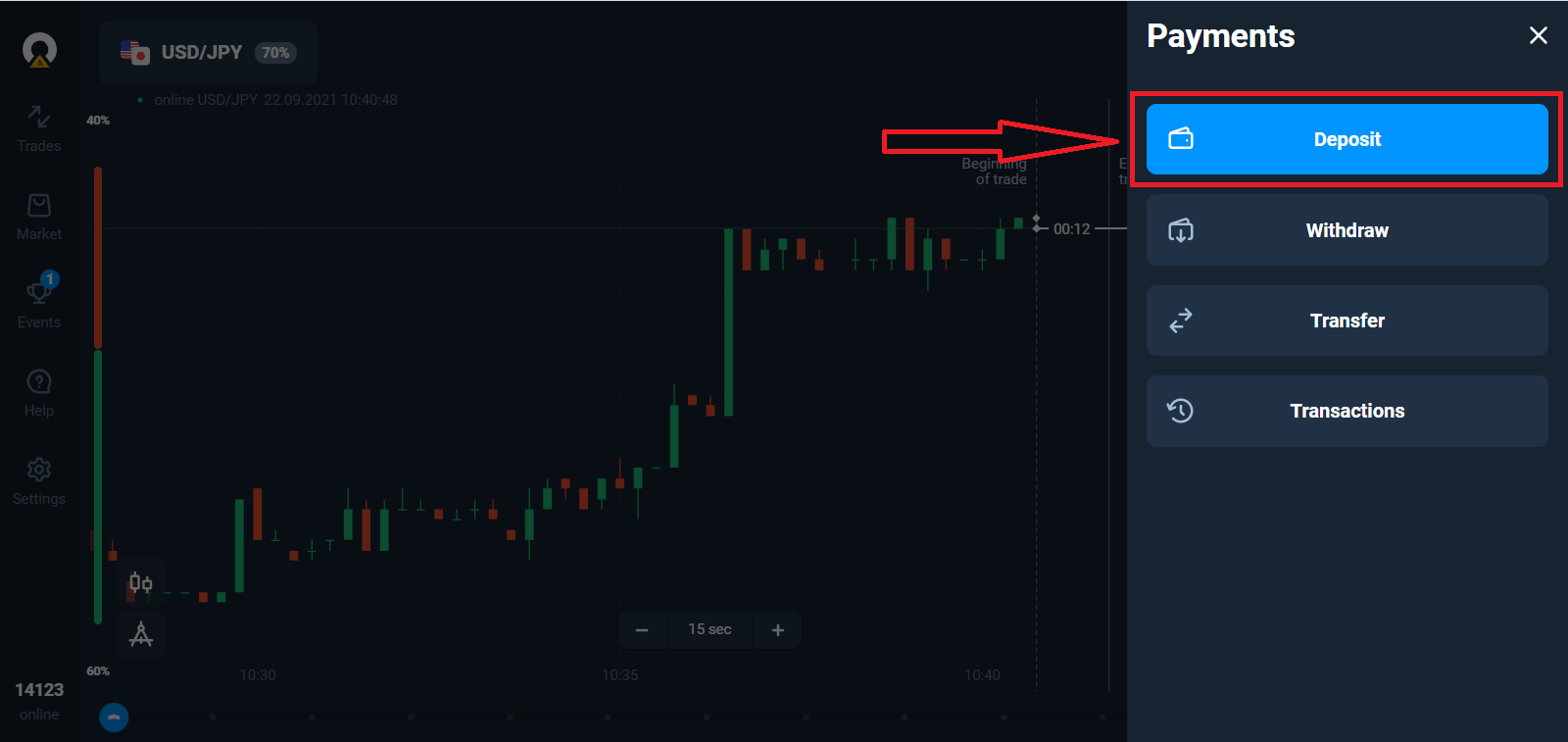

Go to the Deposit page.

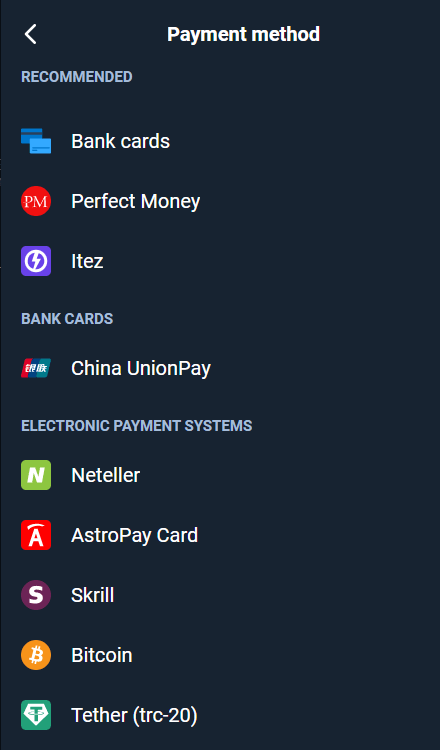

Select a payment method and enter the amount of your deposit. The minimum deposit amount is just $10/€10. However, it may vary for different countries.

Some of Payment Options in the list.

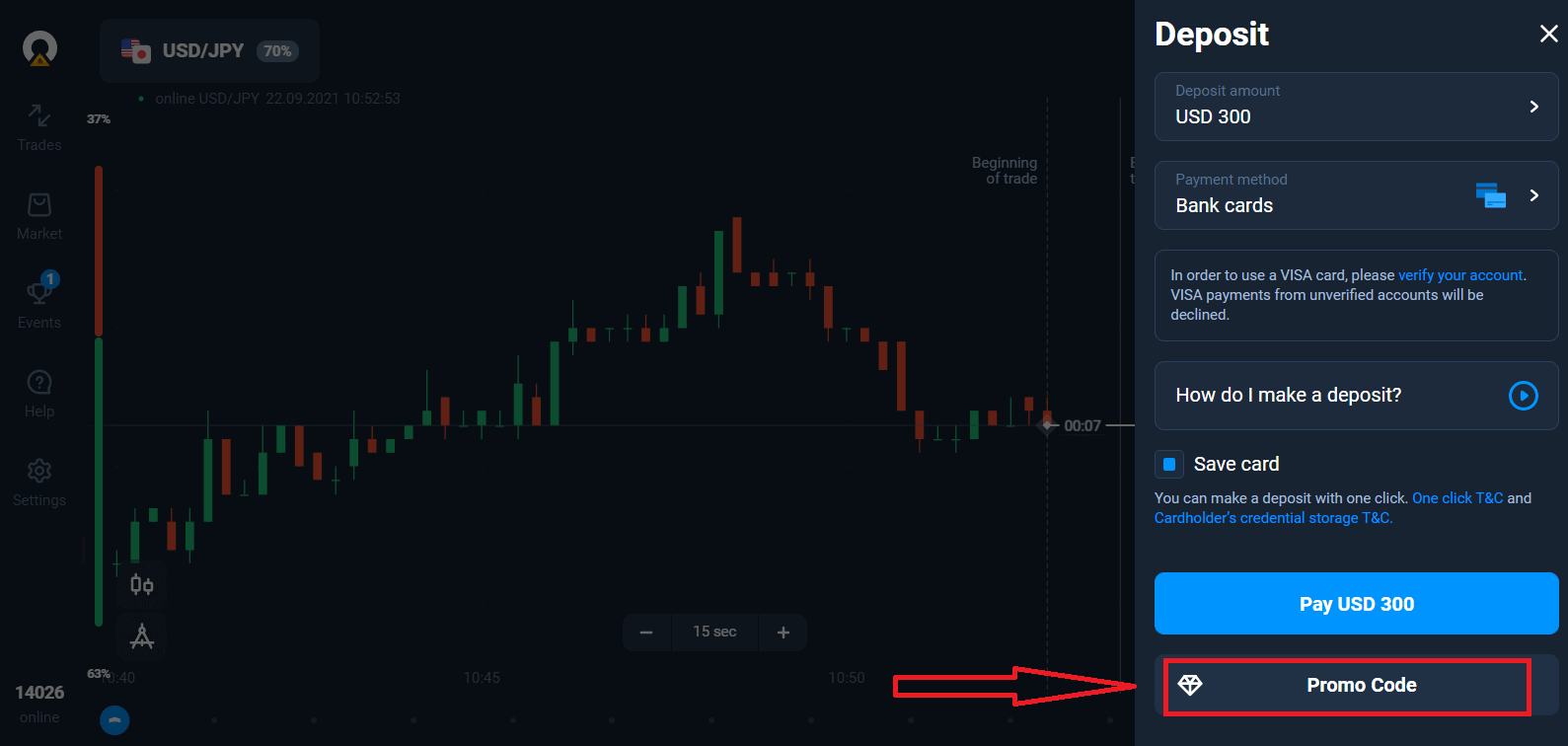

The system may offer you a deposit bonus, take advantage of the bonus to increase the deposit.

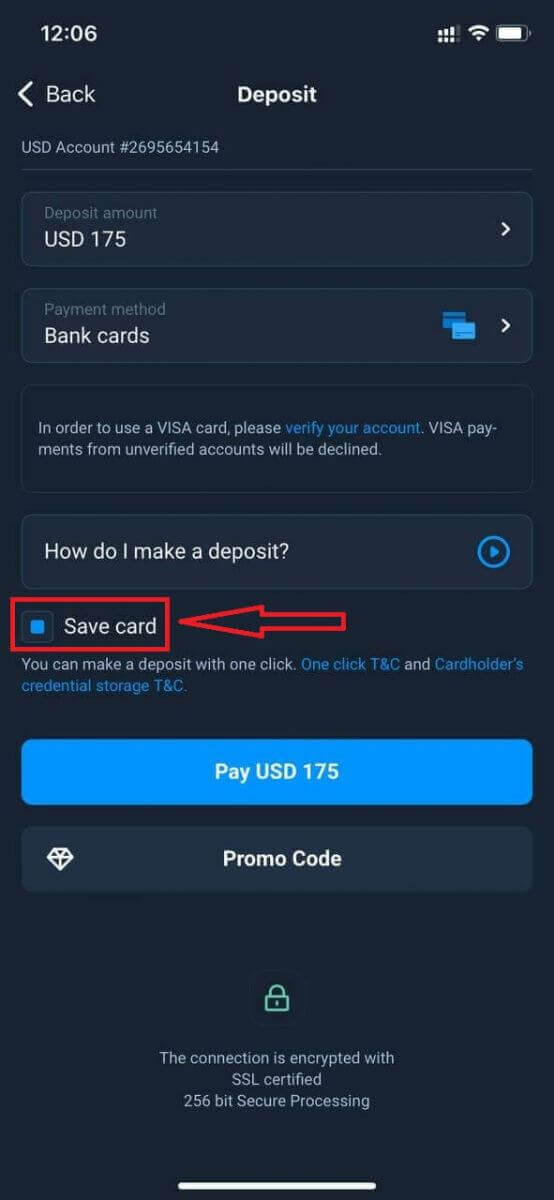

If you top up with a bank card, you can store your card details to make one-click deposits in the future.

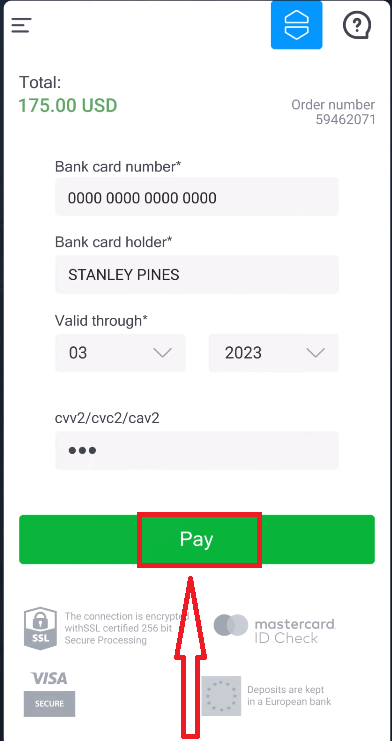

Click "Pay..." blue button.

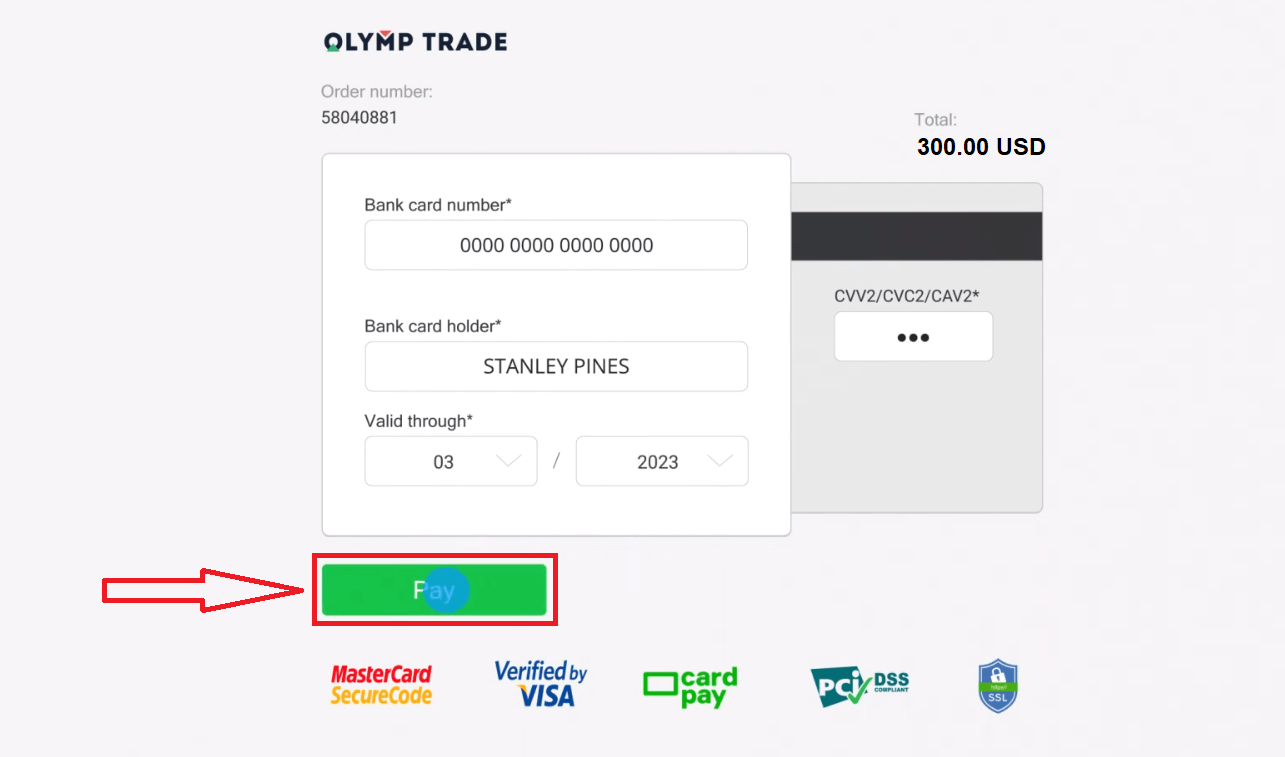

Enter the card data and click "Pay".

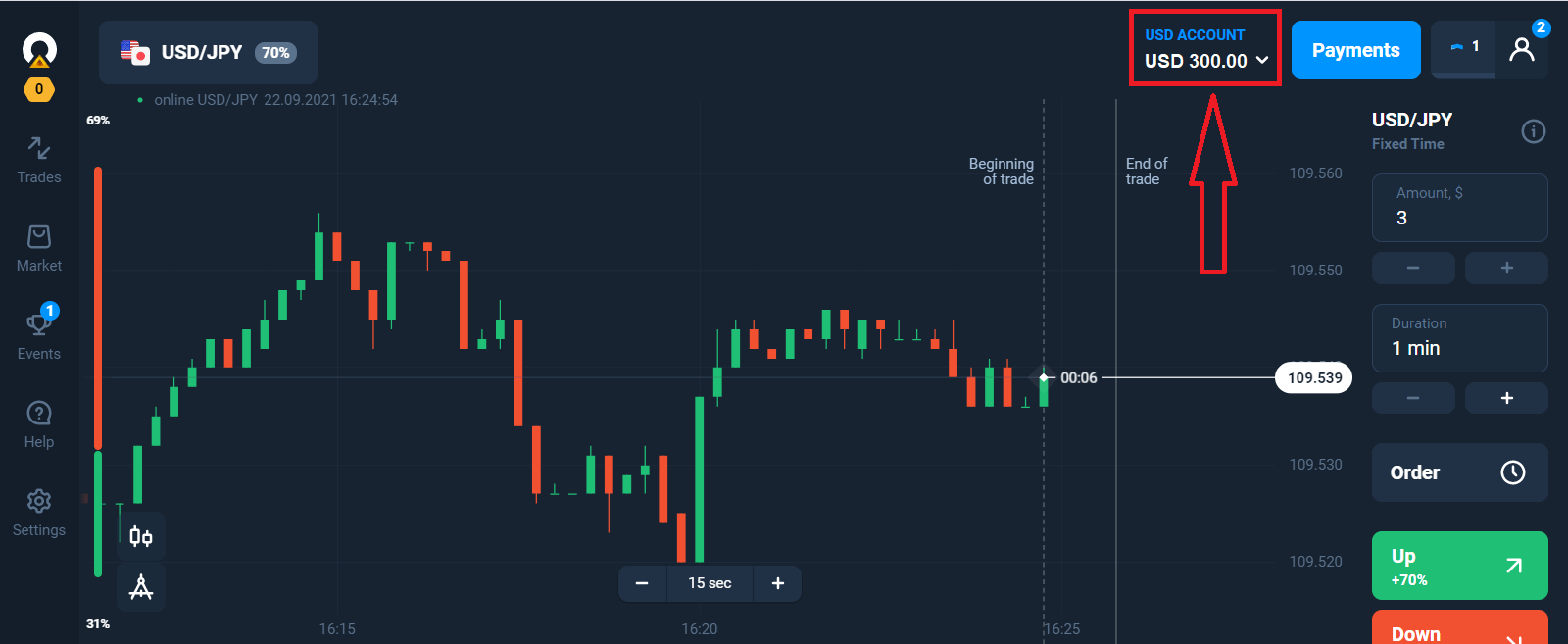

Now You can trade on Real Account.

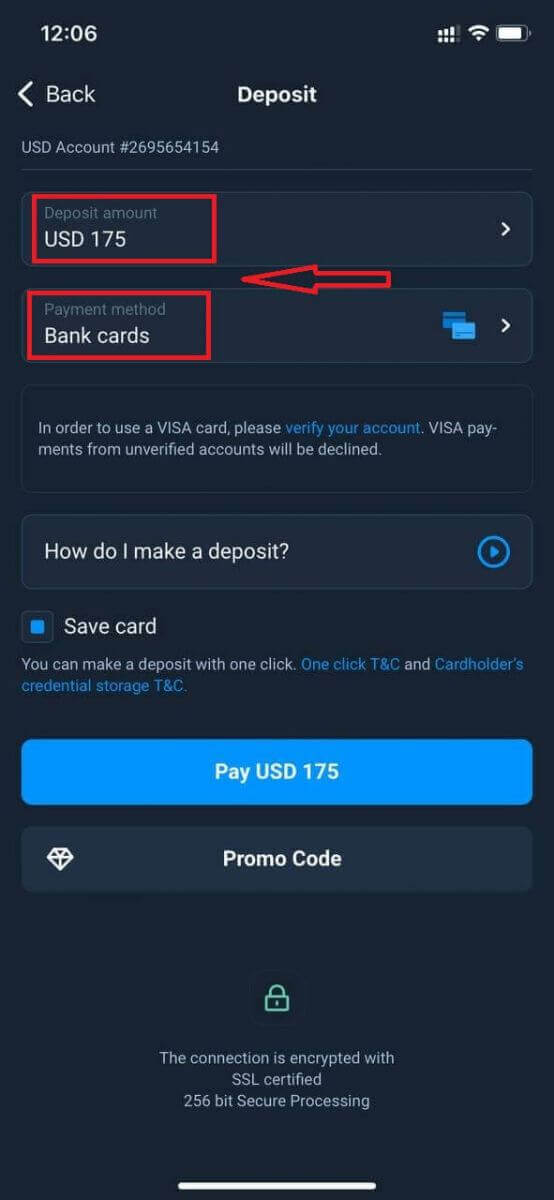

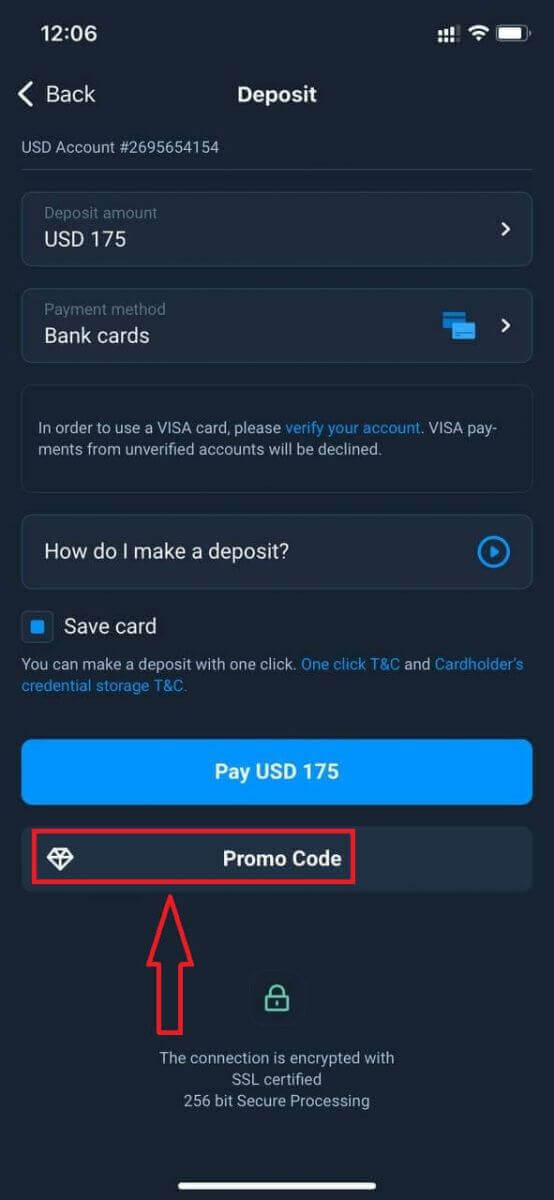

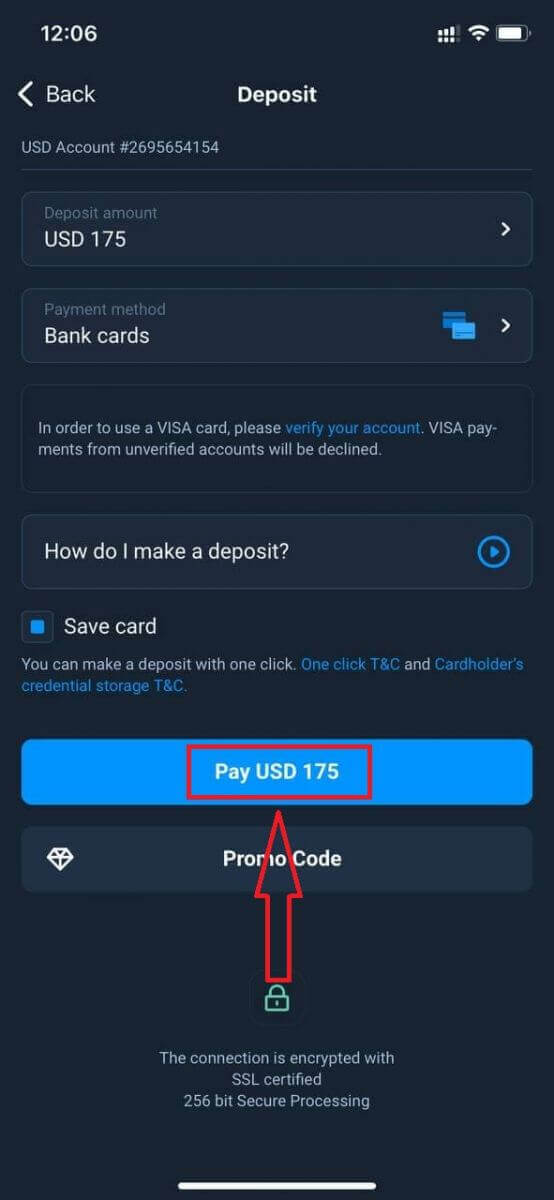

Deposit using Mobile device

Click "Deposit" button.

Select a payment method and enter the amount of your deposit. The minimum deposit amount is just $10/€10. However, it may vary for different countries.

Some of Payment Method in the list.

The system may offer you a deposit bonus, take advantage of the bonus to increase the deposit.

If you top up with a bank card, you can store your card details to make one-click deposits in the future.

Click "Pay...".

Enter the card data and click "Pay" green button.

Now you can trade on Real Account.

When will the funds be credited?

The funds are usually credited to trading accounts fast, but sometimes it can take from 2 to 5 business days (depending on your payment provider.)If the money has not been credited to your account right after you make a deposit, please wait for 1 hour. If after 1 hour there is still no money, please wait and check again.

How to Trade at Olymptrade

What are "Fixed Time Trades"?

Fixed Time Trades (Fixed Time, FTT) is one of the trading modes available on the Olymptrade platform. In this mode, you make trades for a limited period of time and receive a fixed rate of return for a correct forecast about the movements in currency, stock and other asset prices.Trading in Fixed Time mode is the easiest way to earn money on changes in the value of financial instruments. However, to achieve positive results, you need to take a training course and practice with a free demo account available on Olymptrade.

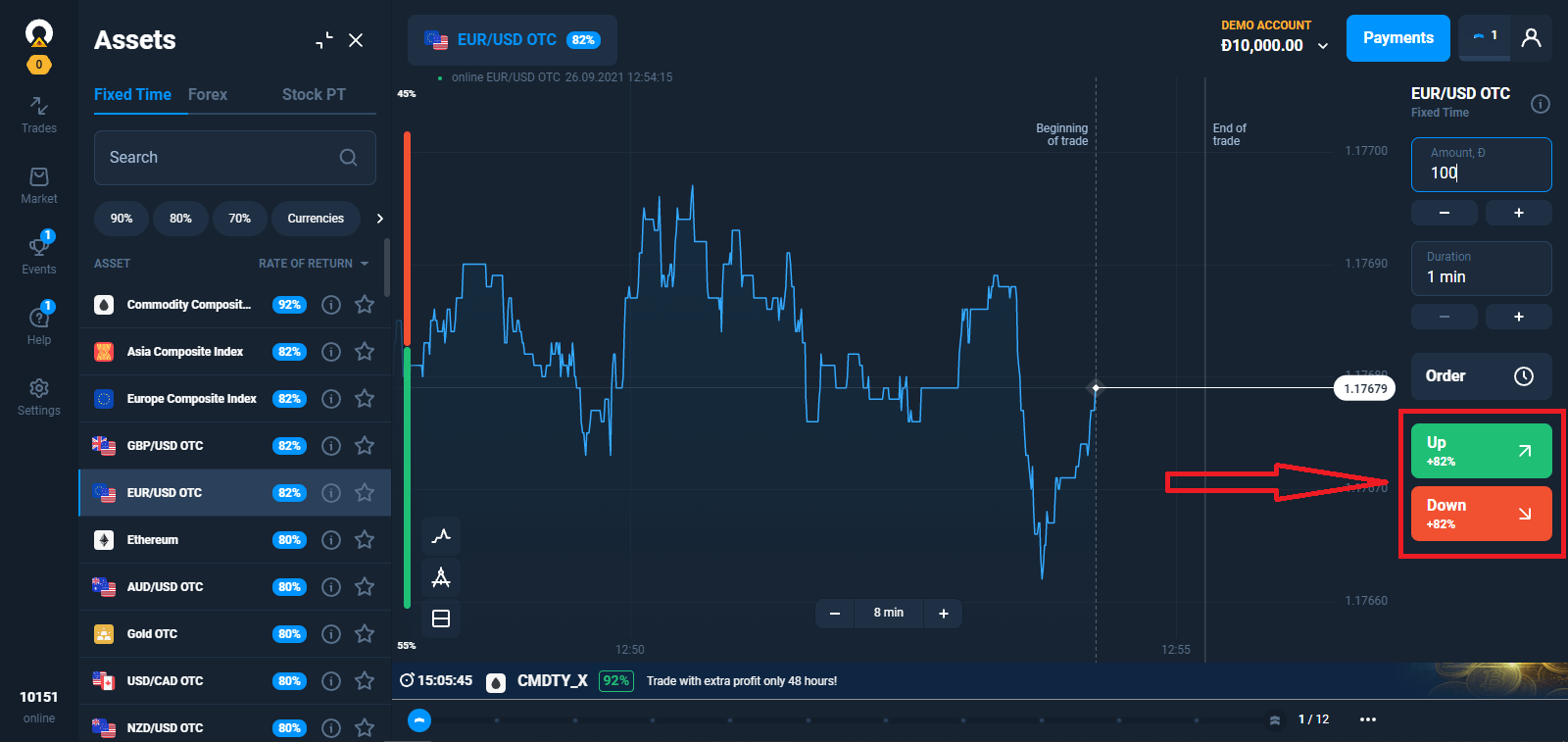

How do I Trade?

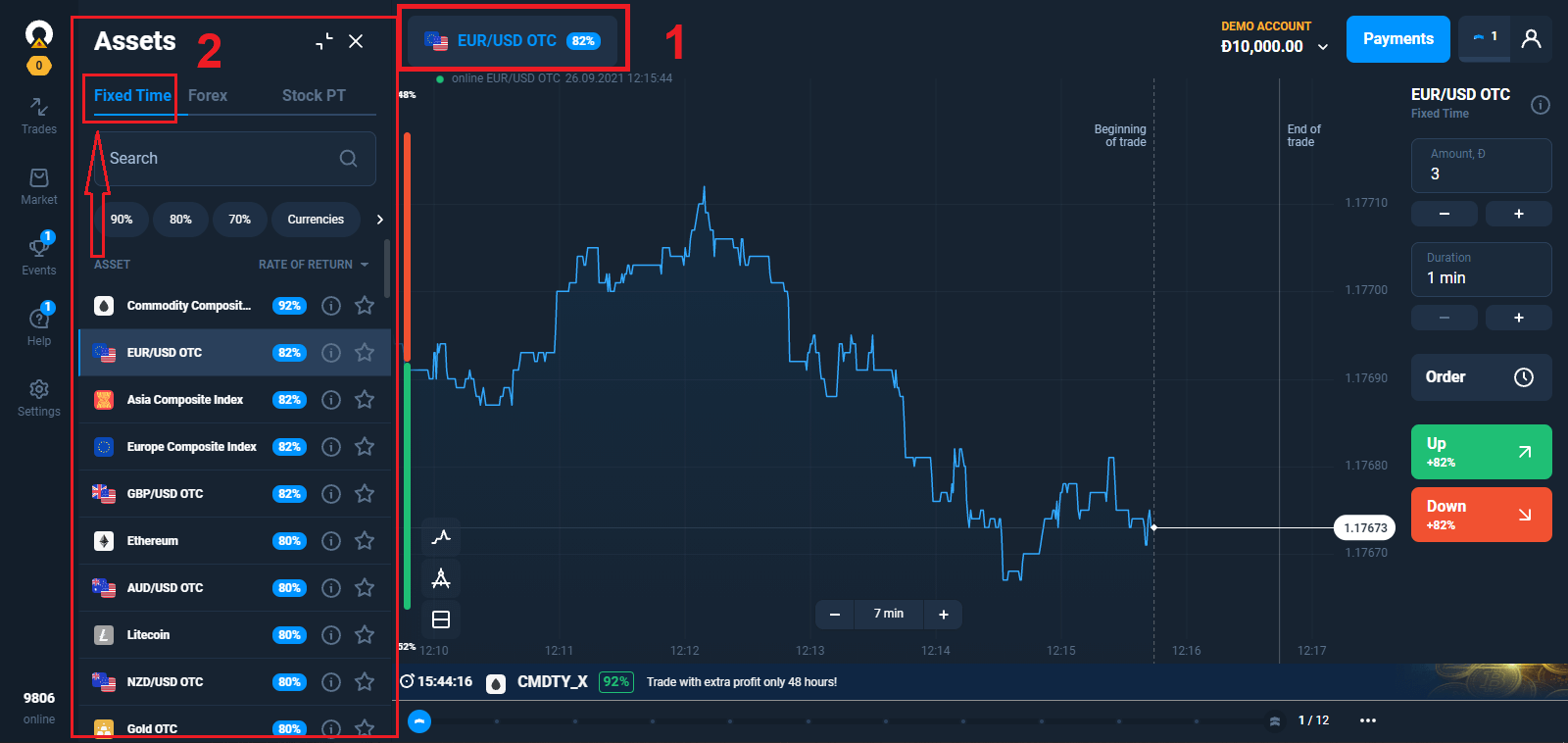

1. Choose asset for trading

- You can scroll through the list of assets. The assets that are available to you are colored white. Click on the assest to trade on it.

- The percentage next to the asset determines its profitability. The higher the percentage – the higher your profit in case of success.

All trades close with the profitability that was indicated when they were opened.

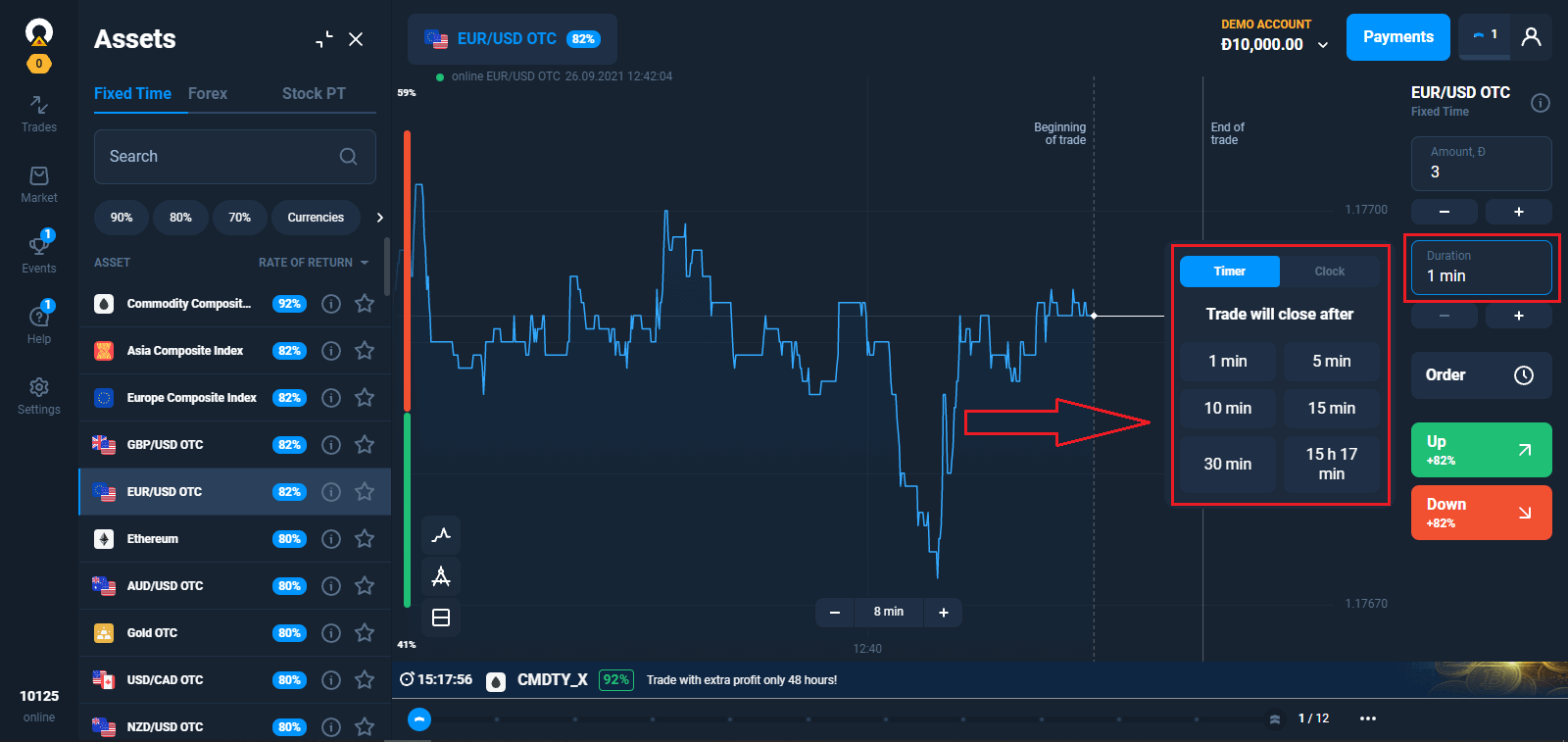

2. Choose an Expiration Time

The expiration period is the time after which the trade will be considered completed (closed) and the result is automatically summed up.

When concluding a trade with Fixed Time, you independently determine the time of execution of the transaction.

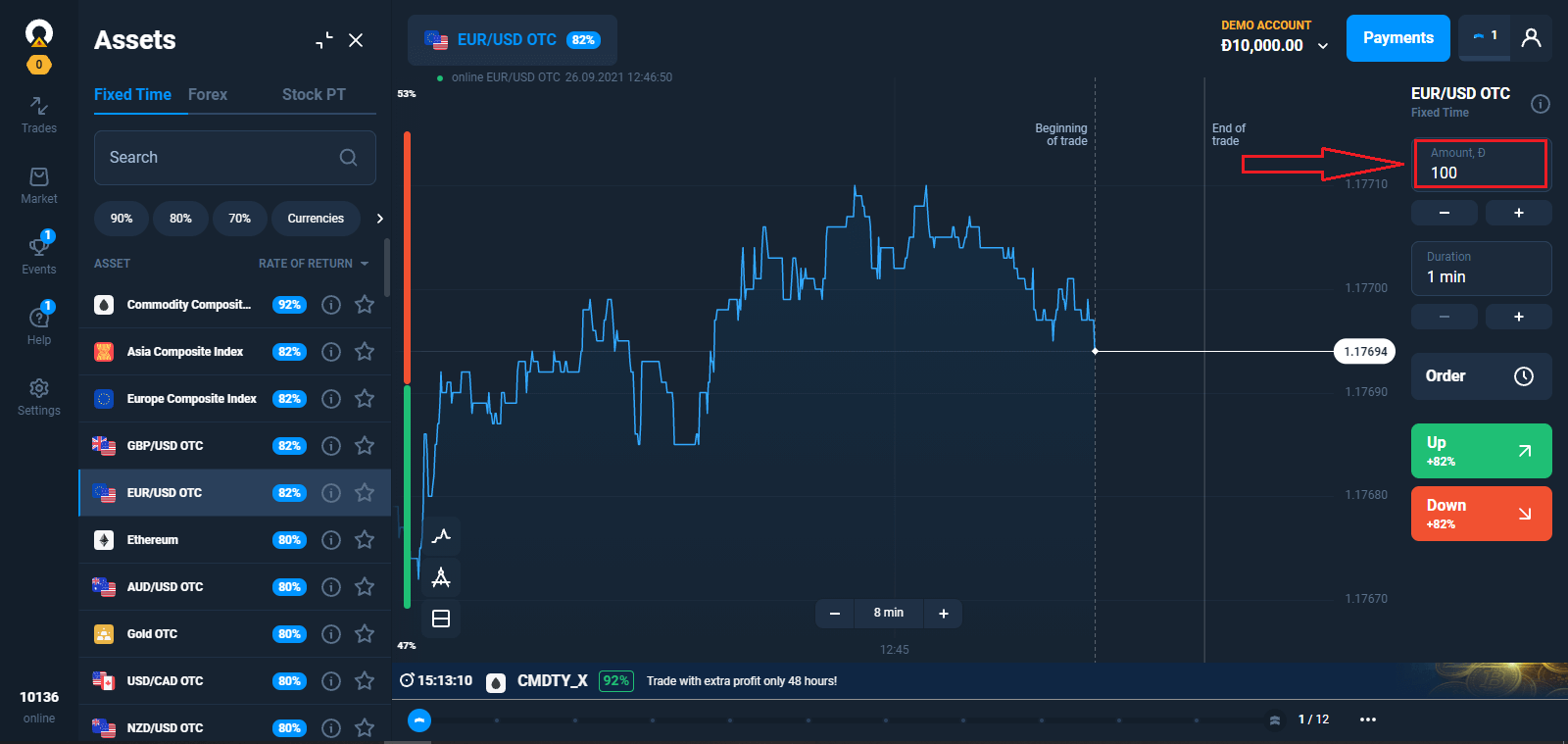

3. Set the amount you’re going to invest.

The minimum investment amount is $1/€1.

For a trader with a Starter status, the maximum trade amount is $3,000/€3,000. For a trader with an Advanced status, the maximum trade amount is $4,000/€4,000. For a trader with an Expert status, the maximum trade amount is $5,000/€5,000.

We recommend you start with small trades to test the market and get comfortable.

4. Analyze the price movement on the chart and make your forecast.

Choose Up (Green) or Down (Red) options depending on your forecast. If you think that the asset price will go up by the end of the selected time period, press the green button. If you plan to profit from a decline in the rate, press the red button.

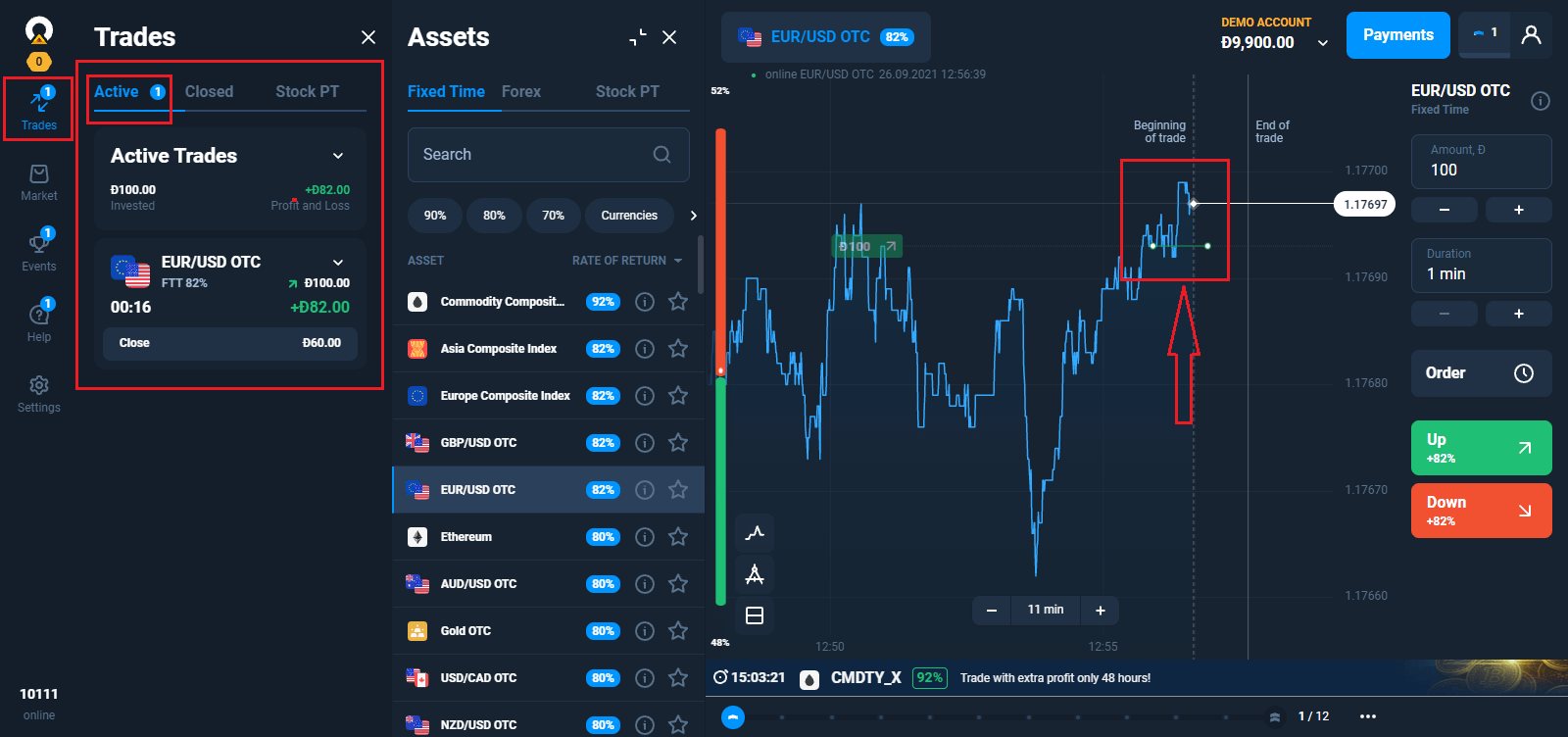

5. Wait for the trade to close to find out whether your forecast was correct. If it was, the amount of your investment plus the profit from the asset would be added to your balance. If your forecast was incorrect – the investment would not be returned.

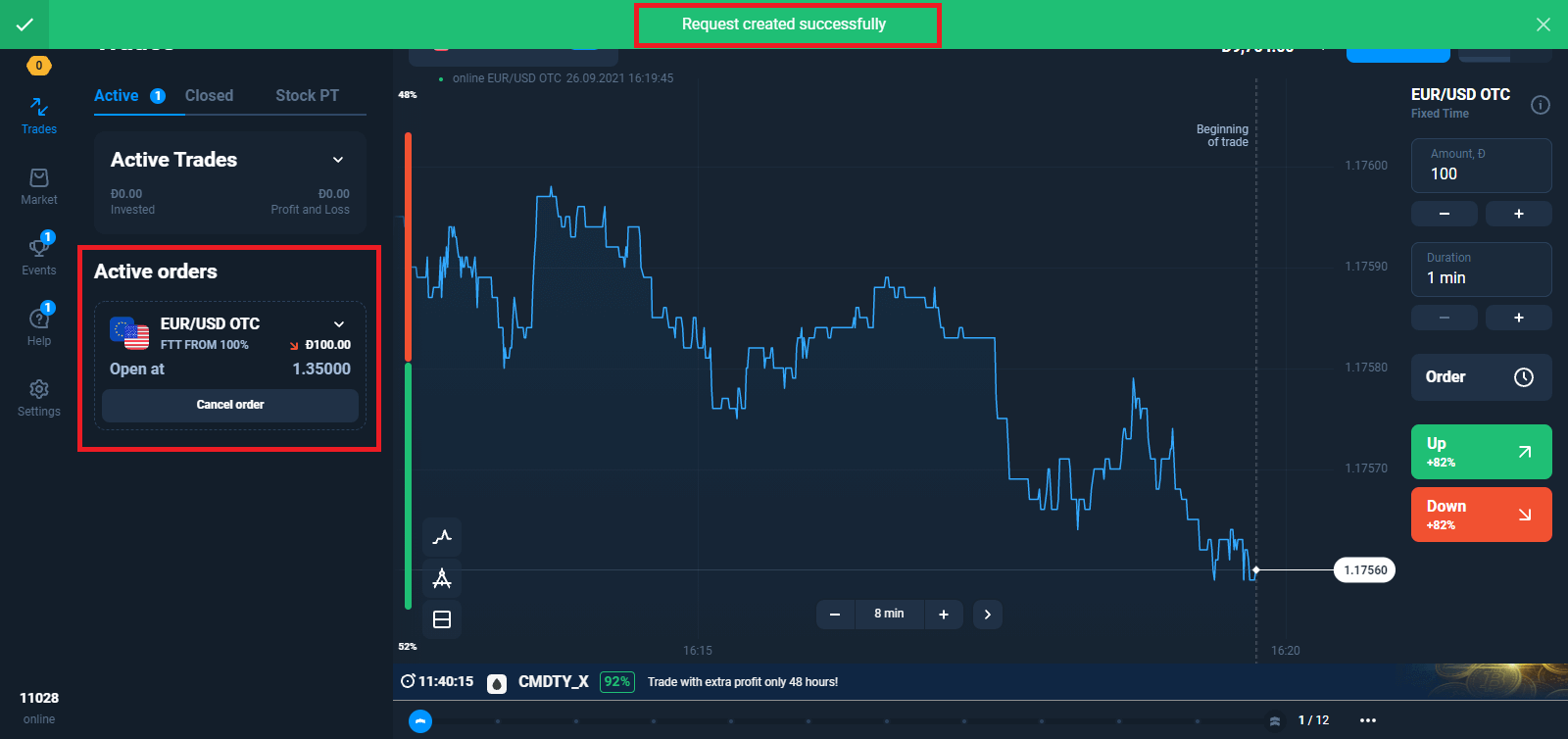

You can monitor the Progress of your Order in The Trades

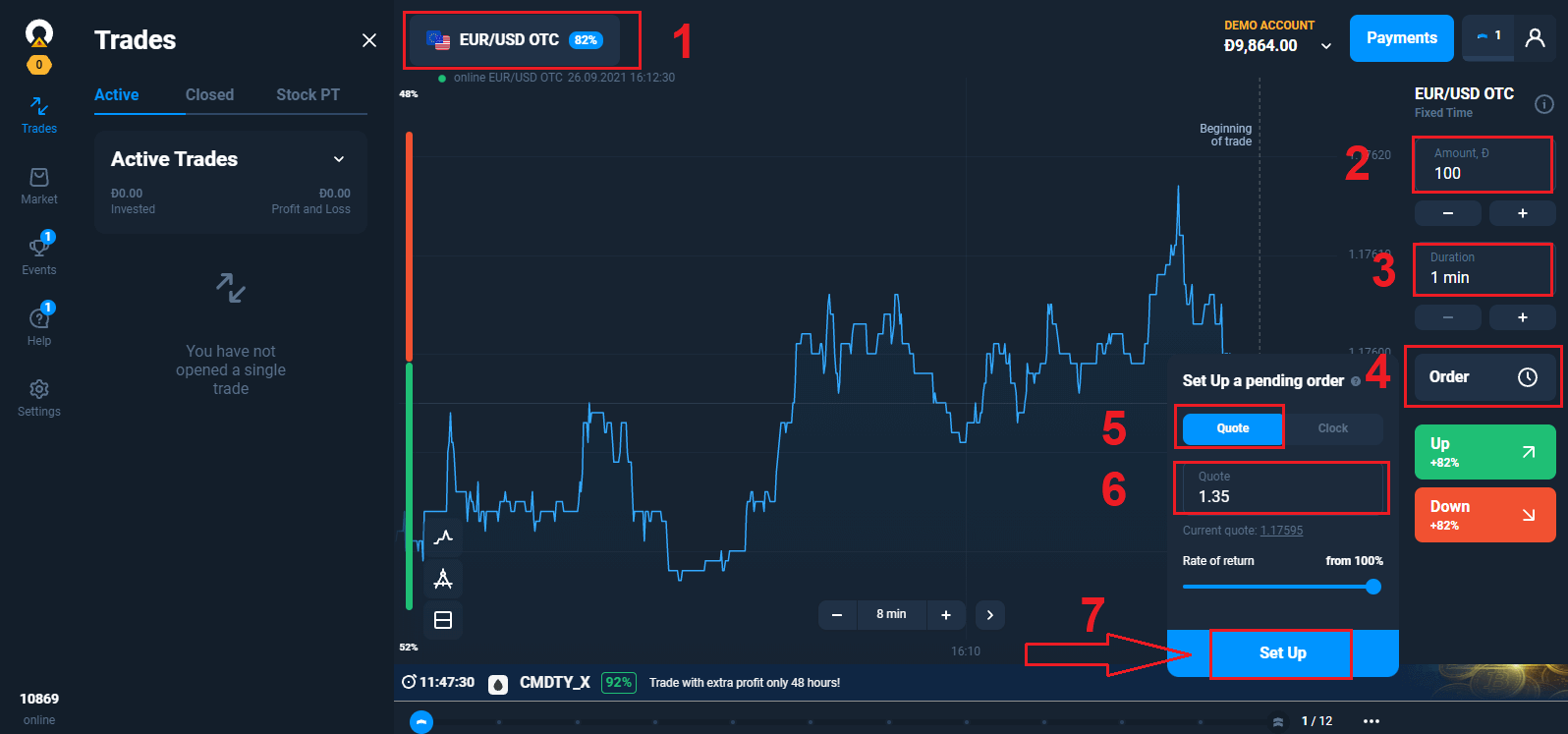

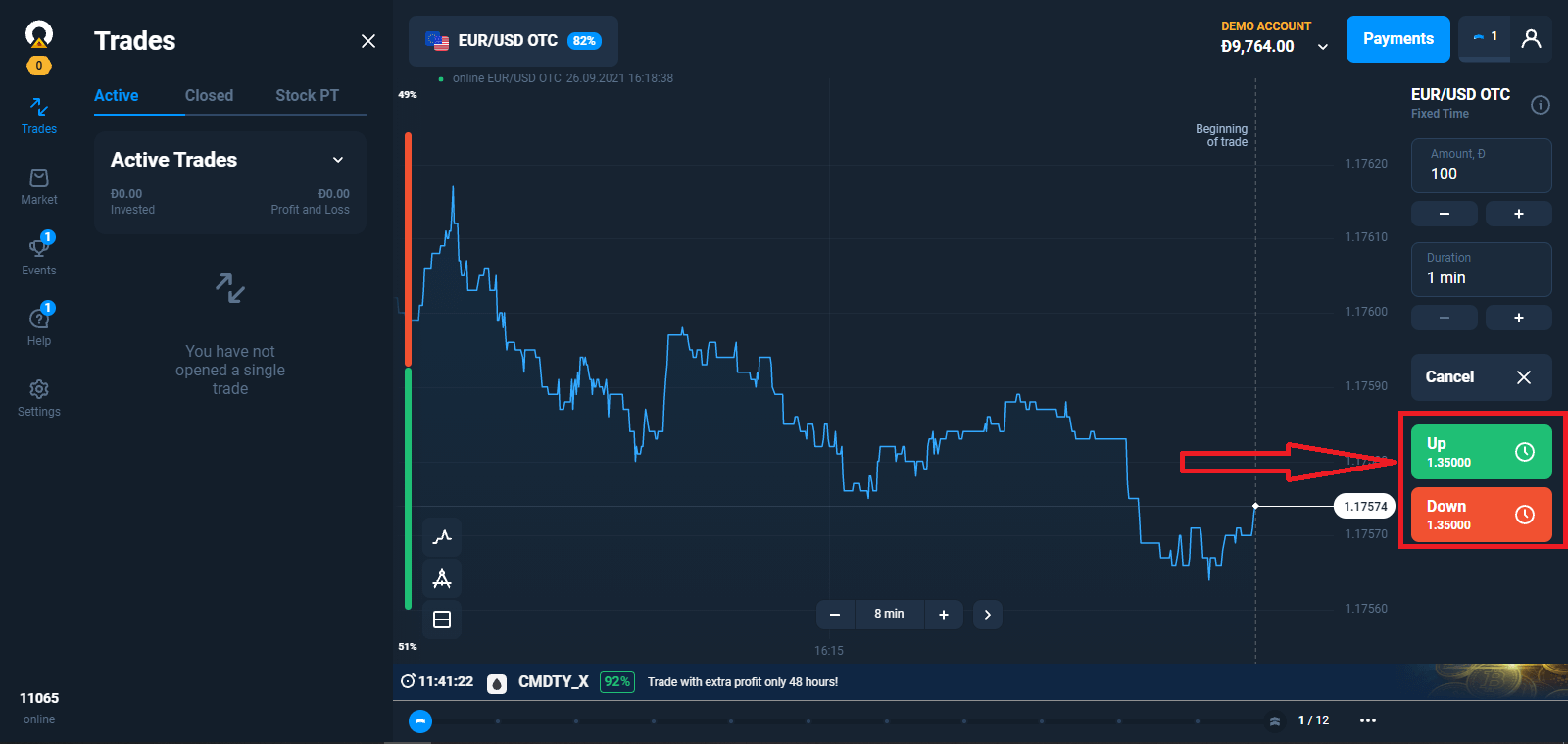

Pending Orders

The pending trade mechanism enables you to delay trades or trade when an asset reaches a certain price. This is your order to buy (sell) an option when parameters you specify are met.A pending order can be made only for a "classic" type of option. Note that the return is applicable as soon as the trade is opened. That is, your trade is executed on the basis of the actual return, not on the basis of the percentage of profit when the request was created.

Making a Pending Order Based on an Asset Price

Select the asset, expiration time, and trade amount. Determine the quote at which your trade is supposed to open.

Make a forecast UP or DOWN. If the price of the asset you selected goes up (down) to the specified level or passes through it, your order turns into a trade.

Note that, if the asset price passes the level you set, the trade will open at the actual quote. For example, the asset price is at 1.0000. You want to open a trade at 1.0001 and create an request, but the next quote comes in at 1.0002. The trade will open at the actual 1.0002.

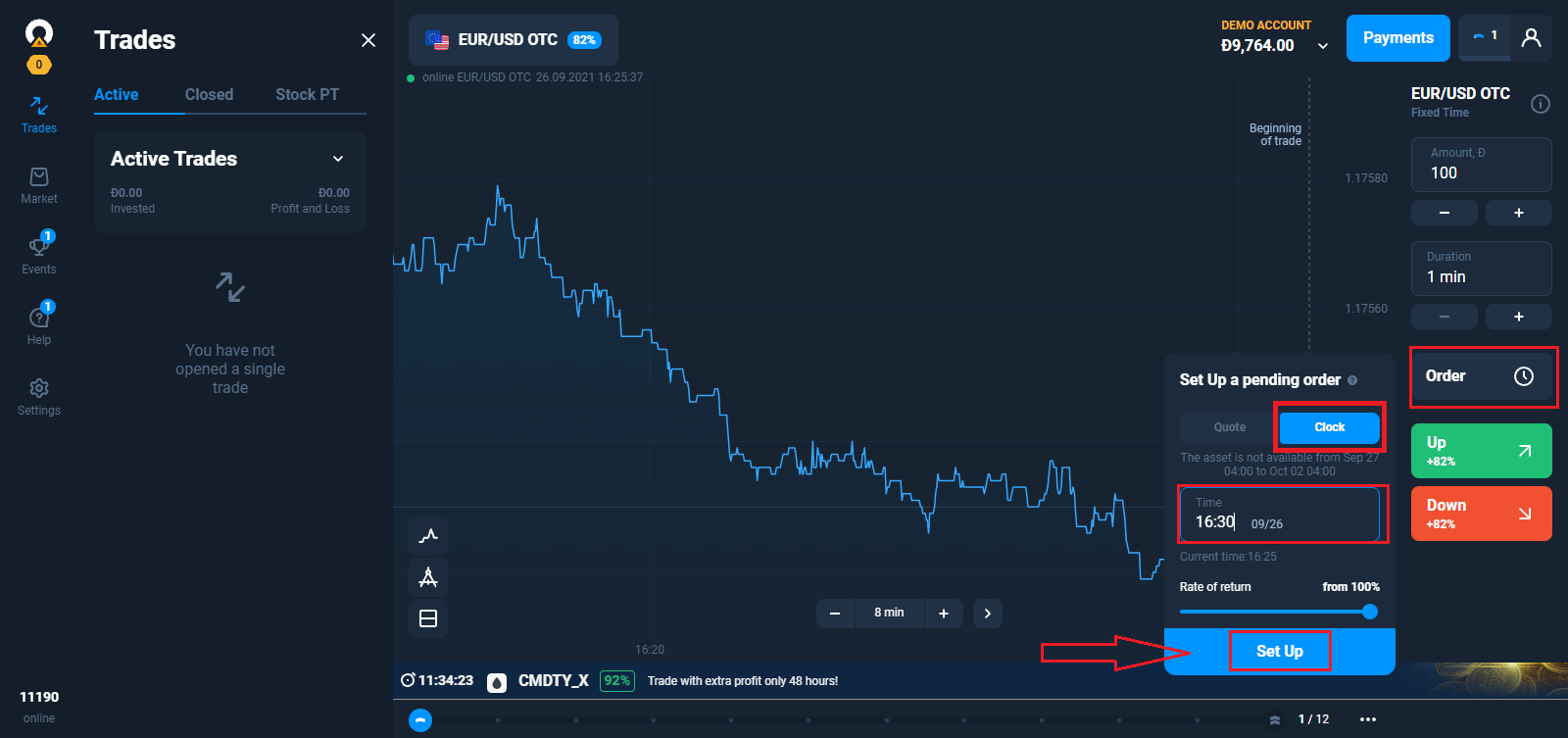

Making a Pending Order for a Specified Time

Select the asset, expiration time, and trade amount. Set the time at which your trade is supposed to open. Make a forecast UP or DOWN. The trade will open right at the time you identified in your order.

Order life

Any order request you submit is valid for one trading session and expires after 7 days. You can cancel your request at any time before the order opens without losing the money you planned to spend on that trade.

Automatic Order Cancellation

A pending order request cannot be executed if:

– the specified parameters have not been achieved before 9:00 PM UTC;

– the specified expiration time is greater than the time remaining until the end of the trading session;

– there are insufficient funds on your account;

– 20 trades were already opened when the target was reached (the number is valid for Starter user profile; for Advanced, it is 50, and for Expert - 100).

If at the time of expiration your forecast proves correct, you will make a profit up to 92%. Otherwise, you will make a loss.

How to trade successfully?

To predict the future market value of assets and make money on it, traders use different strategies.One of the possible strategies is to work with news. As a rule, it is chosen by beginners.

Advanced traders take into account many factors, use indicators, know how to predict trends.

However, even professionals have losing trades. Fear, uncertainty, lack of patience or the desire to earn more bring losses even to experienced traders. Simple rules of risk management help to keep emotions under control.

Technical and Fundamental Analysis for Trading Strategies

There are many trading strategies, but they can be divided into two types, which differ in the approach to forecasting the price of the asset. It can be technical or fundamental analysis.In the case of strategies based on technical analysis, the trader identifies market patterns. For this purpose, graphical constructions, figures and indicators of technical analysis, as well as candlestick patterns are used. Such strategies usually imply strict rules for opening and closing trades, setting limits on loss and profit (stop loss and take profit orders).

Unlike technical analysis, fundamental analysis is carried out "manually". The trader develops their own rules and criteria for the selection of transactions, and makes a decision based on the analysis of market mechanisms, the exchange rate of national currencies, economic news, revenue growth and profitability of an asset. This method of analysis is used by more experienced players.

Why You Need a Trading Strategy

Trading in financial markets without strategy is a blind game: today is lucky, tomorrow is not. Most traders who dont have a specific plan of action are abandoning trading after a few failed trades — they just dont understand how to make a profit.Without a system with clear rules for entering and exiting a trade, a trader can easily make an irrational decision. Market news, tips, friends and experts, even the phase of the moon — yes, there are studies that link the position of the Moon relative to the Earth with the cycles of movement of assets - can cause the trader to make mistakes or to start too many transactions.

Advantages of Working With Trading Strategies

The strategy removes emotions from trading, for example, greed, because of which traders begin to spend too much money or open more positions than usual. Changes in the market can cause panic, and in this case, the trader should have a ready plan of action.

In addition, the use of the strategy helps to measure and improve their performance. If trading is chaotic, there is a risk of making the same mistakes. Therefore, it is important to collect and analyze the statistics of the trading plan in order to improve it and increase profits.

It is worth noting that you do not need to rely entirely on trading strategies — it is always important to check the information. The strategy may work well in the theory based on the past market data, but it does not guarantee success in real time.

How to Withdraw Money from Olymptrade

The Olymptrade platform strives to meet the highest quality standards of carrying out financial transactions. What is more, we keep them simple and transparent.The funds withdrawal rate has increased tenfold since the company was founded. Today, more than 90% of requests are processed during one trading day.

However, traders often have questions about the funds withdrawal process: which payment systems are available in their region or how they can speed up the withdrawal.

For this article, we collected the most frequently asked questions.

What Payment Methods Can I Withdraw Funds To?

You can only withdraw funds to your payment method.If you have made a deposit using 2 payment methods, a withdrawal to each of them should be proportional to the payment amounts.

Do I Need to Provide Documents to Withdraw Funds?

There’s no need to provide anything in advance, you will only have to upload documents upon request. This procedure provides additional security for the funds in your deposit.If your account needs to be verified, you will receive an instruction on how to do it by email.

How do I Withdraw Money

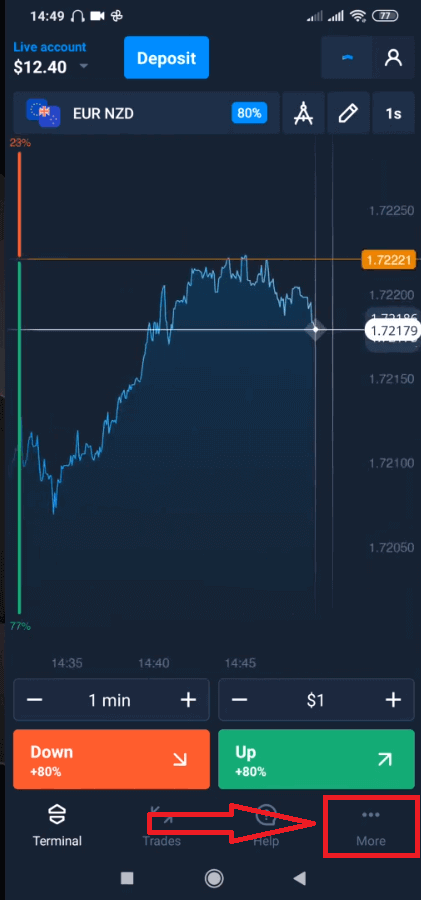

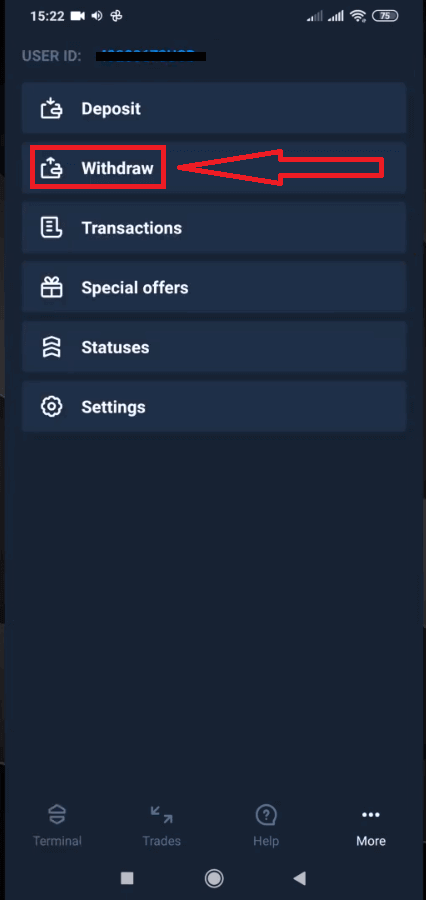

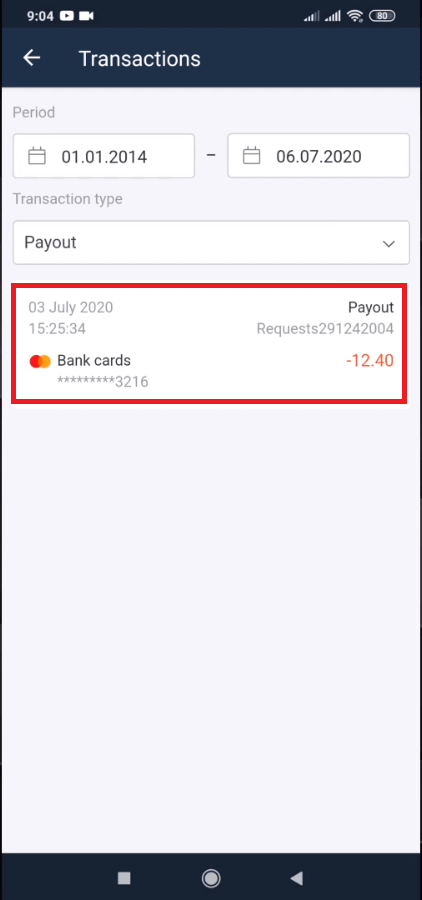

Withdrawal using Mobile Device

Go to your platform user account and select "More".

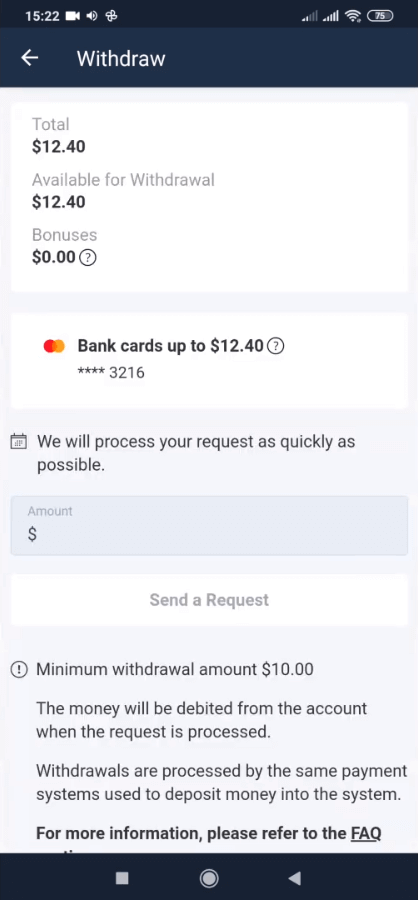

Select "Withdraw".

It will lead you to a special section on the Olymptrade website.

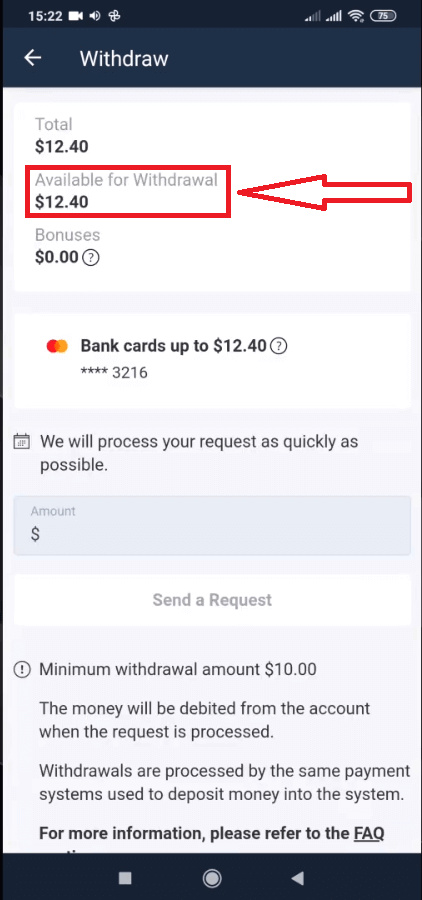

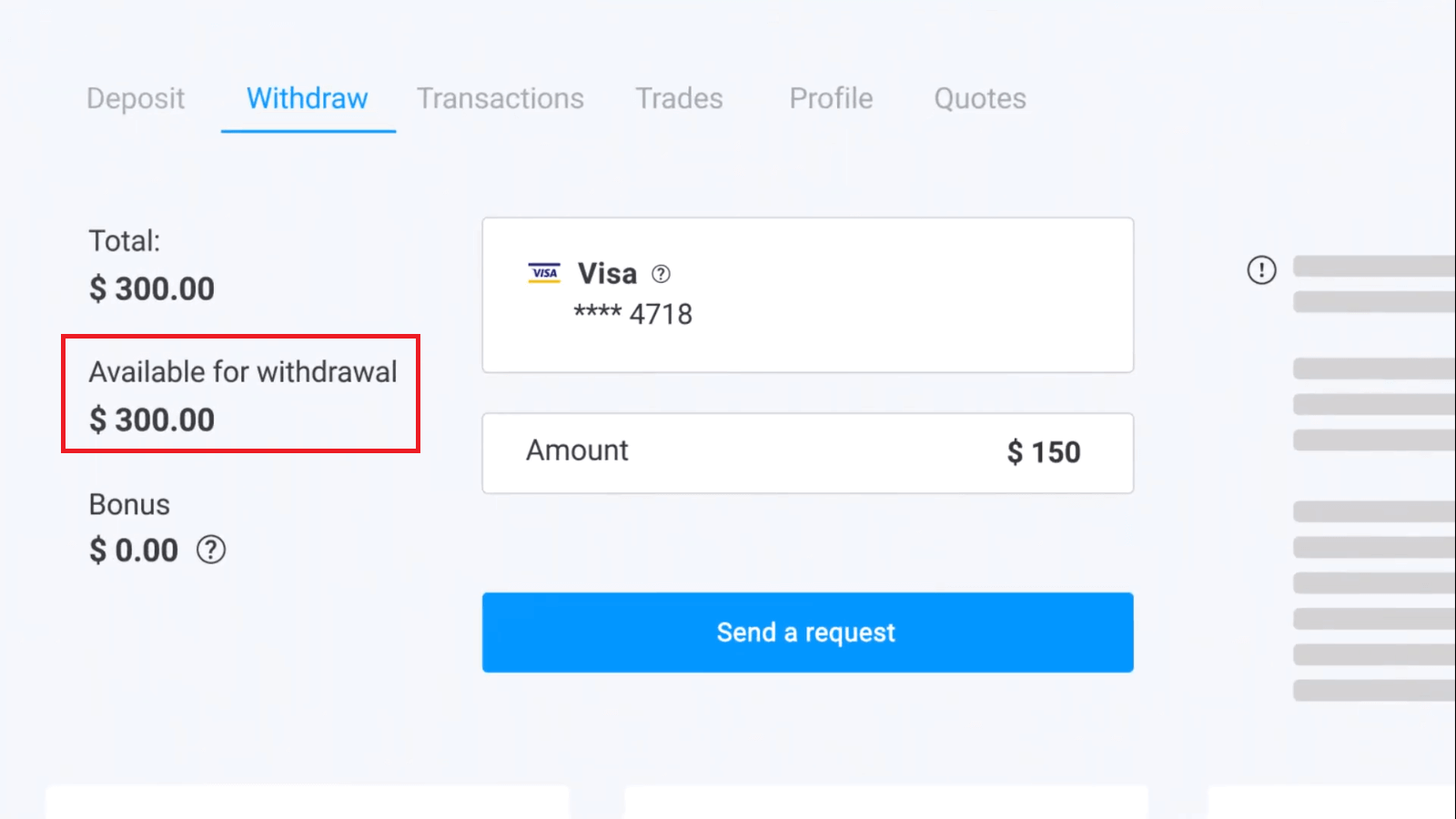

In the “Available for withdrawal” block you will find the information about how much you can withdraw.

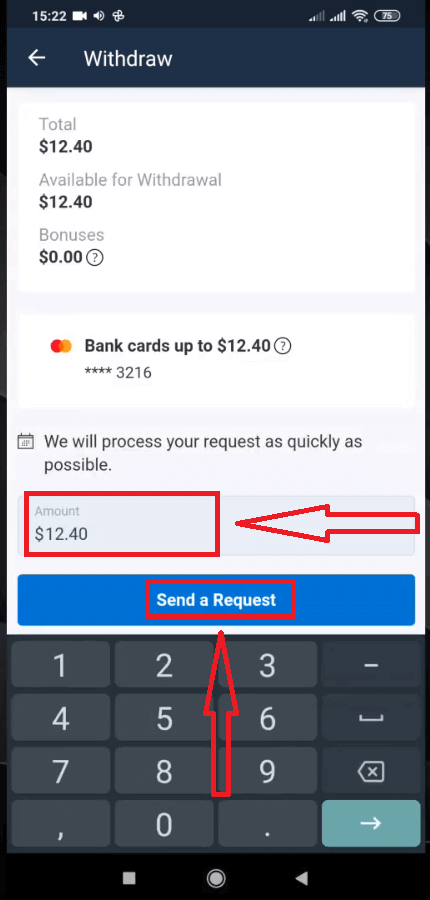

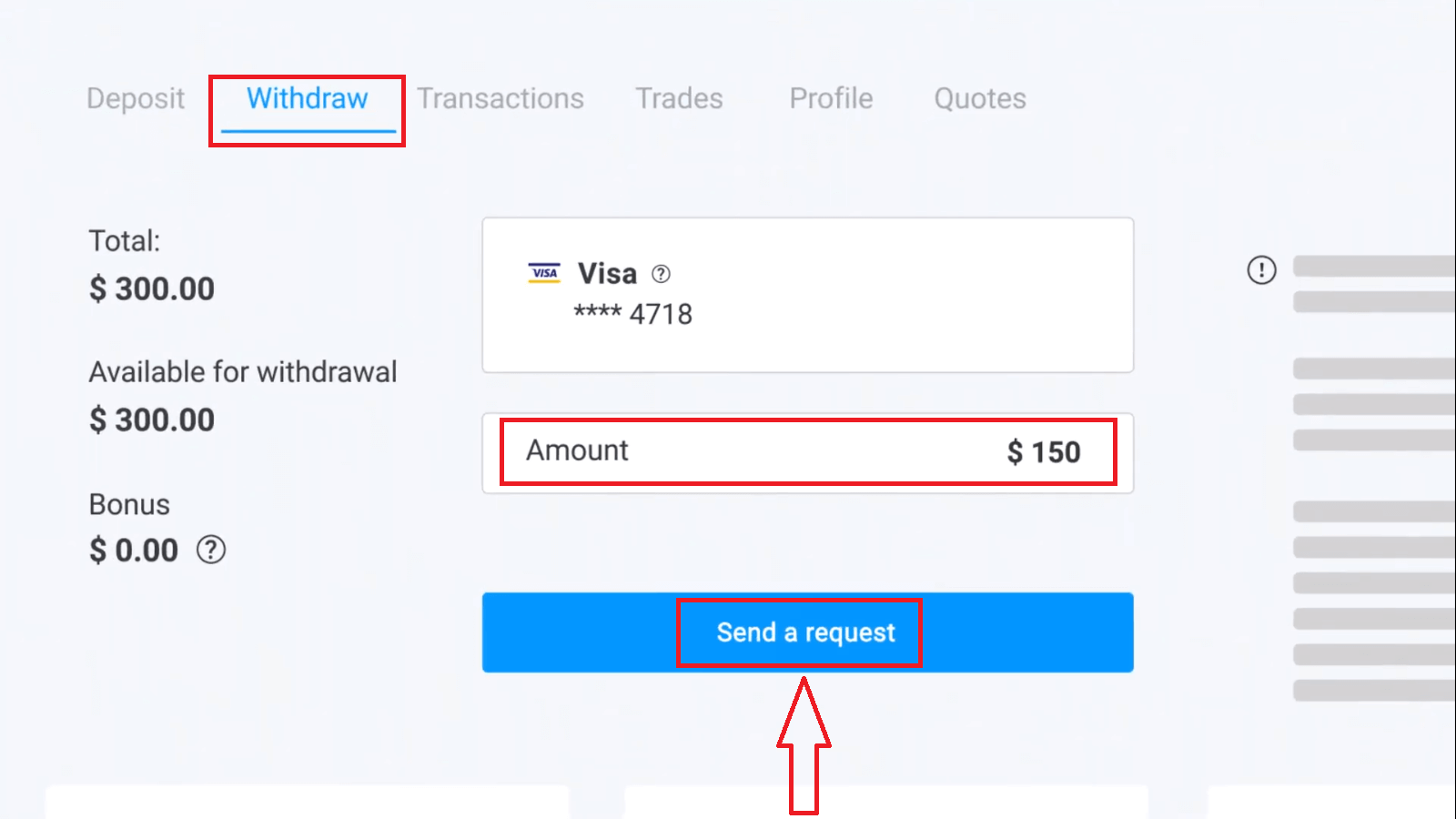

Select the amount. The minimum withdrawal amount is $10/€10/R$50, but it may vary for different payment systems. Click “Send a Request”.

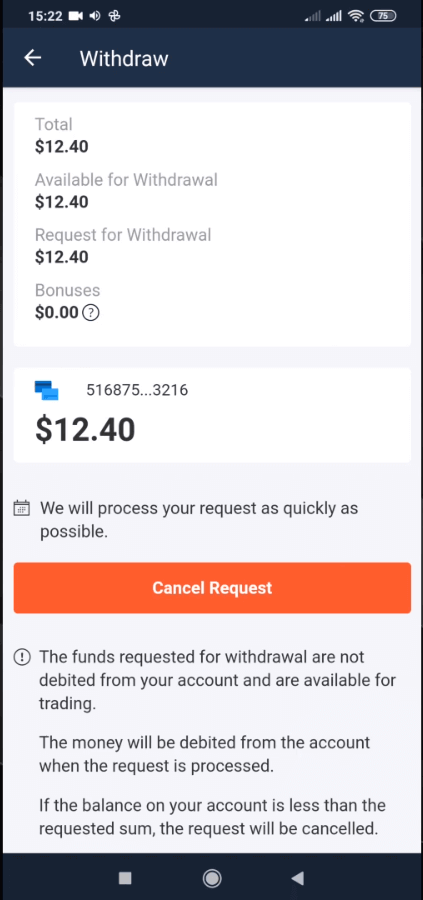

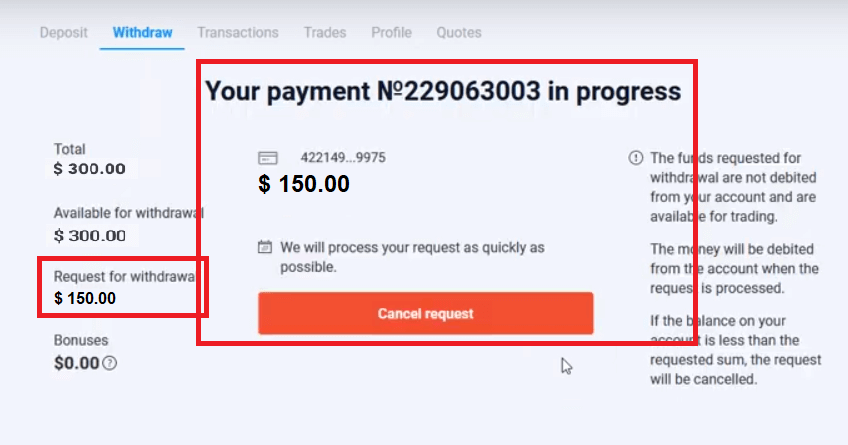

Wait a few seconds, you will see your request.

Check your payment in Transactions.

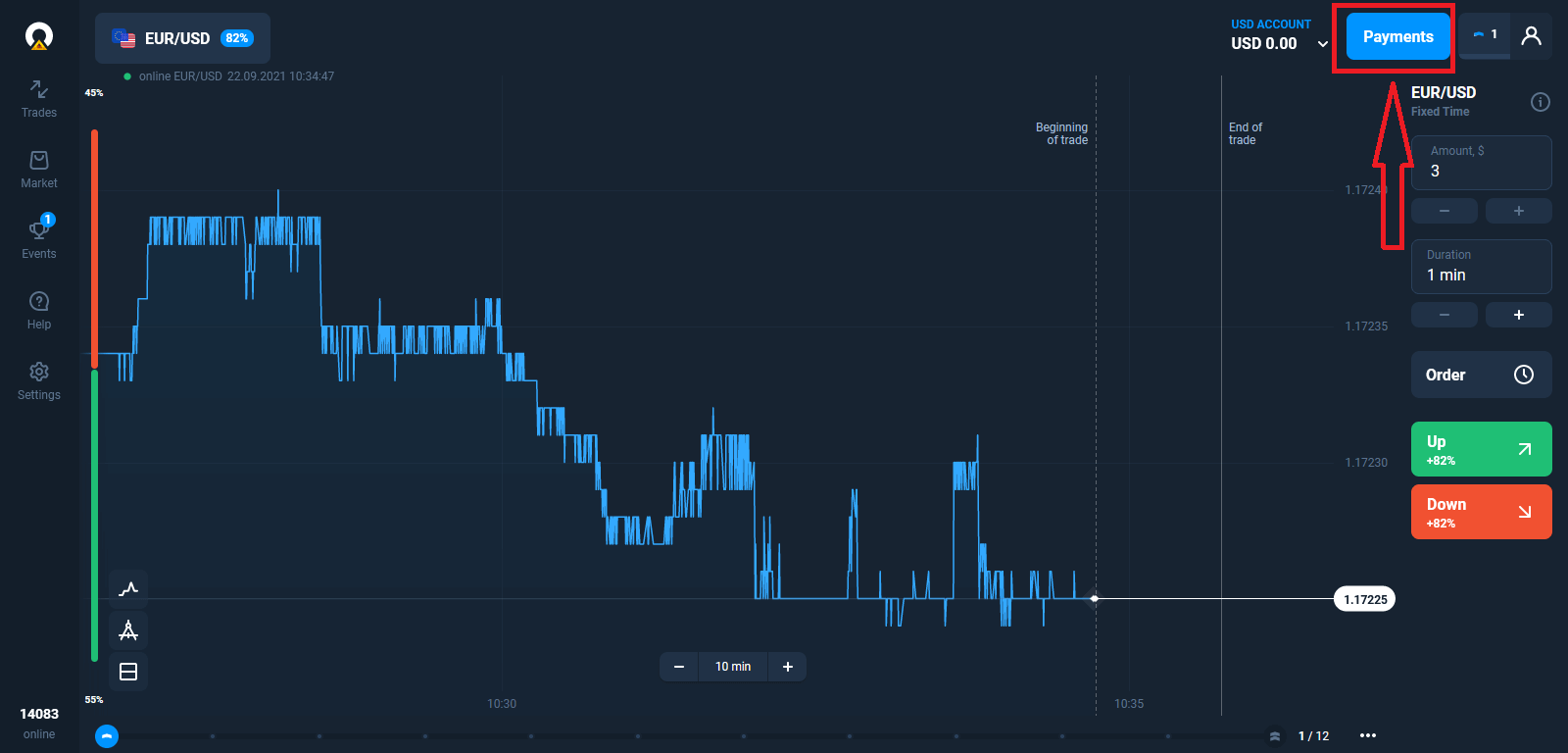

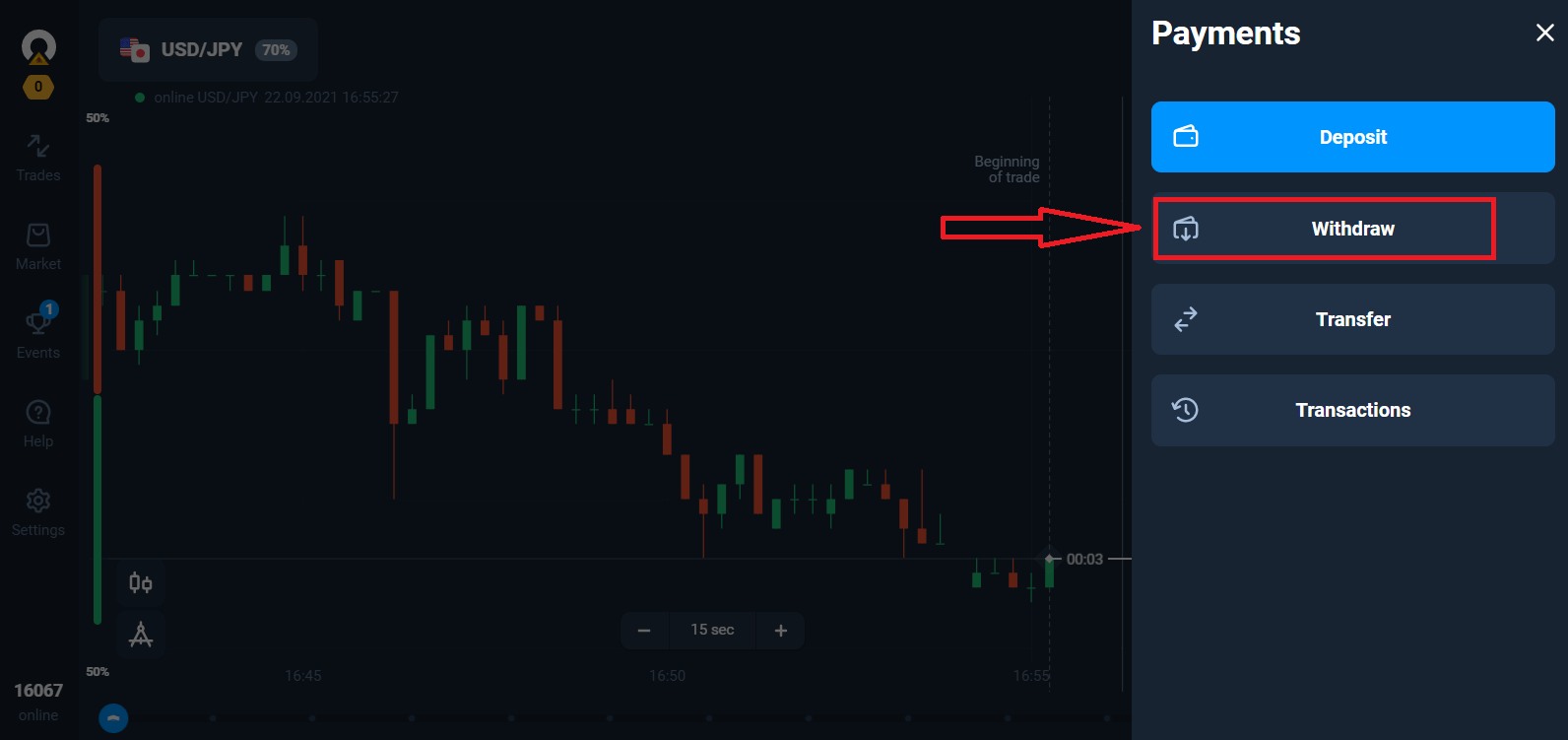

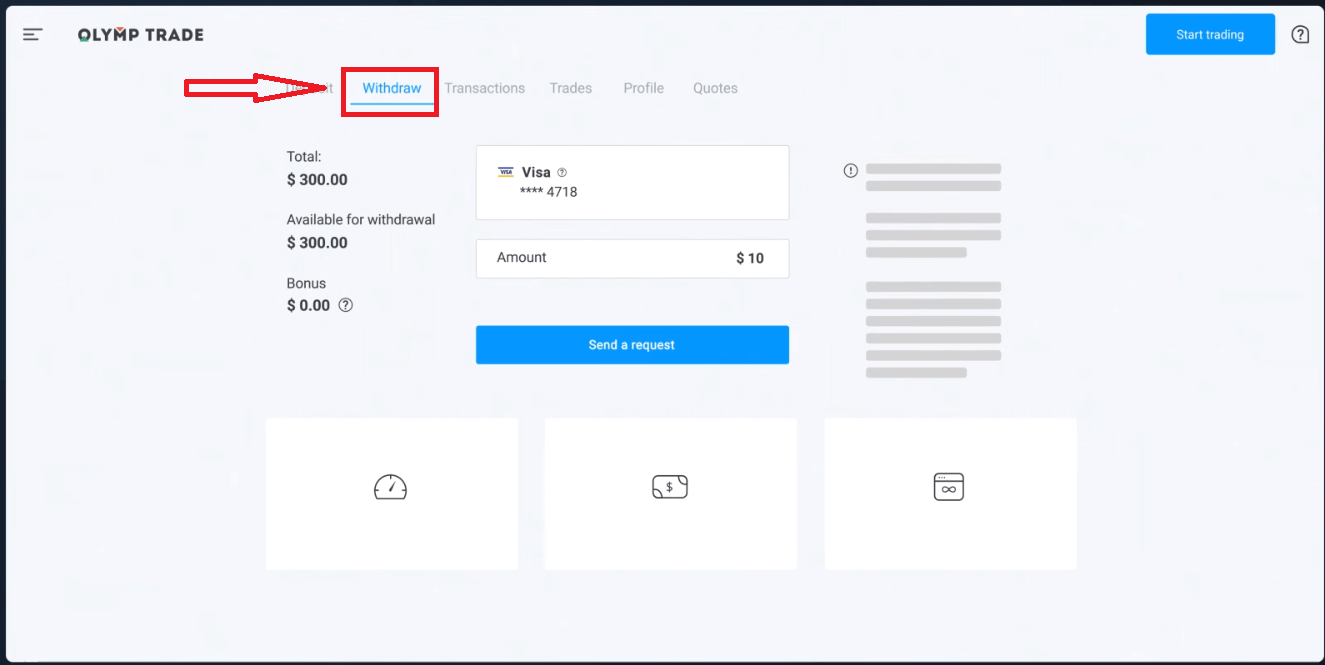

Withdrawal using Desktop

Go to your platform user account and click "Payments" button.

Select “Withdraw”.

It will lead you to a special section on the Olymptrade website.

In the “Available for withdrawal” block you will find the information about how much you can withdraw.

Select the amount. The minimum withdrawal amount is $10/€10/R$50, but it may vary for different payment systems. Click “Send a Request”.

Wait a few seconds, you will see your payment.

Frequently Asked Questions (FAQ)

Account

What are multi accounts?

Multi-Accounts is a feature that allows traders to have up to 5 interconnected live accounts on Olymptrade. During the creation of your account, youll be able to choose among available currencies, like USD, EUR, or some local currencies.

You will have a full control over those accounts, so you are free to decide on how to use them. One could become a place where you keep the profits from your trades, another can be dedicated to a specific mode or strategy. You can also rename these accounts and archive them.

Please note that account in Multi-Accounts are not equal to your Trading Account (Trader ID). You can only have one Trading Account (Trader ID), but up to 5 different live accounts connected to it to store your money.

How to Create a Trading Account in Multi-Accounts

To create another live account, you need to:

1. Go to the "Accounts" menu;

2. Click on the "+" button;

3. Choose the currency;

4. Write the new accounts name.

Thats it, youve got a new account.

Bonuses Multi-Accounts: How It Works

If you have multiple live accounts while receiving a bonus, then it will be sent to the account that you are depositing funds to.

During the transfer between the trading accounts, a proportional amount of bonus money will be automatically sent alongside the live currency. So, if you, for example, have $100 in real money and a $30 bonus on one account and decide to transfer $50 to another, $15 bonus money will be transferred as well.

How to Archive Your Account

If you wish to archive one of your live accounts, please ensure that it satisfies the following criteria:

1. It contains no funds.

2. There are no open trades with money on this account.

3. It is not the last live account.

If everything is in order, you will be able to archive it.

You still the ability to look through that accounts history even after archivation, as the trade history and financial history are available via the users Profile.

What Is a Segregated Account?

When you deposit funds onto the platform, they are transferred directly to a segregated account. A segregated account is essentially an account that belongs to our company but is separate from the account that stores its operational funds.

We use only our own working capital to support our activities such as product development and maintenance, hedging, as well as business and innovative activities.

Advantages of a Segregate Account

Using a segregated account to store our clients’ funds, we maximize transparency, provide the platform users with uninterrupted access to their funds, and protect them from possible risks. Although this is unlikely to happen, if the company went bankrupt, your money would be 100% safe and can be refunded.

How Can I Change the Account Currency

You can only select the account currency once. It cannot be changed over time.

You can create a new account with a new email and select the desired currency.

If you have created a new account, contact support to block the old one.

According to our policy, a trader can only have one account.

Verification

Why is verification needed?

Verification is dictated by financial service regulations and is necessary to ensure the security of your account and financial transactions.Please note that your information is always kept safe and is only used for compliance purposes.

Here are all the required documents to complete account verification:

– Passport or a government-issued ID

– 3-D selfie

– Proof of address

– Proof of payment (after you have deposited funds into your account)

When do I need to verify my account?

You can freely verify your account anytime you want. However, it is important to remember that once you have received an official verification request from our company, the process becomes mandatory and needs to be completed within 14 days.Normally, verification is requested when you attempt any type of financial operations on the platform. However, there might be other factors.

The procedure is a common condition among the majority of the reliable brokers and is dictated by regulatory requirements. The aim of the verification process is to ensure the security of your account and transactions as well as meet anti-money laundering and Know Your Customer requirements.

In what cases do I need to complete verification again?

1. New payment method. You will be asked to complete verification with every new payment method used.2. Missing or outdated version of the documents. We may ask for missing or correct versions of the documents needed to verify your account.

3. Other reasons include if you would like to change your contact information.

What documents do I need to verify my account?

If you would like to verify your account, you will need to provide the following documents:Situation 1. Verification before depositing.

To verify your account before depositing, you will need to upload proof of identity (POI), a 3-D selfie, and proof of address (POA).

Situation 2. Verification after depositing.

To complete verification after depositing money to your account, you will need to upload proof of identity (POI), a 3-D selfie, proof of address (POA), and proof of payment (POP).

What is identification?

Completing the identification form is the first step of the verification process. It becomes necessary once you have deposited $250/€250 or more into your account and received an official identification request from our company.Identification needs only be completed once. You will find your identification request in the upper right corner of your profile. After you have submitted the identification form, verification may be requested anytime.

Please note that you will have 14 days to complete the identification process.

Why do I need to complete the identification process?

It is needed to verify your identity and protect your deposited money from unauthorized transactions.Deposit

I Transferred Funds, but They Weren’t Credited to My Account

Make sure the transaction from your side has been completed.If the funds transfer was successful from your side, but the amount was not credited yet to your account, please contact our support team by chat, email, or hotline. You will find all contact information in the "Help" menu.

Sometimes there are some issues with the payment systems. In situations like this, funds are either returned to the payment method or credited to the account with a delay.

Do you charge a brokerage account fee?

If a customer has not made trades in live account or/and has not deposited/withdrawn funds, a $10 (ten US dollars or its equivalent in the account currency) fee will be monthly charged to their accounts. This rule is enshrined in non-trading regulations and KYC/AML Policy.If there are not enough funds in the user account, the amount of the inactivity fee equates to the account balance. No fee will be charged to a zero-balance account. If there is no money in the account, no debt is to be paid to the company.

No service fee is charged to the accont provided that the user makes one trading or non-trading transaction (funds deposit/withdrawal) in their live account within 180 days.

The history of inactivity fees is available in the “Transactions” section of the user account.

Do you charge a fee for making a deposit/withdrawing funds?

No, the company covers the costs of such commissions.

How can I get a bonus?

To receive a bonus, you need a promo code. You enter it when funding your account. There are several ways to get a promo code:– It may be available on the platform (check the Deposit tab).

– It may be received as a reward for your progress on Traders Way.

– Also, some promo codes may be available in the brokers official social media groups/communities.

What happens to my bonuses if I cancel a funds withdrawal?

After making a withdrawal request, you may continue trading using your total balance until the requested amount is debited from your account.While your request is being processed, you may cancel it by clicking the Cancel Request button in the Withdrawal area. If you cancel it, both your funds and bonuses will remain in place and available for use.

If the requested funds and bonuses are already debited from your account, you may still cancel your withdrawal request and recover your bonuses. In this case, contact Customer Support and ask them for assistance.

Trading

Do I Need to Install Any Trading Software on My PC?

You can trade on our online platform in the web version right after you create an account. There is no need to install new software, although free mobile and desktop apps are available to all traders.

Can I use robots when trading on the platform?

A robot is some special software that enables to make trades on assets automatically. Our platform is designed to be used by people (traders). So the use of trading robots on the platform is prohibited.According to Clause 8.3 of the Service Agreement, the use of trading robots or similar trading methods that violate the principles of honesty, reliability, and fairness, is a violation of the Service Agreement.

What Should I Do If a System Error Occurs When Loading the Platform?

When system errors occurs, we recommend clearing your cache and cookies. You should also make sure you are using the latest version of the web browser. If you take these actions but the error still occurs, contact our support team.

The Platform Doesn’t Load

Try opening it in some other browser. We recommend using the latest Google Chrome.The system will not let you log in to the trading platform if your location is blacklisted.

Perhaps, there is an unexpected technical problem. Our support consultants will help you solve it.

Why Doesn’t a Trade Open Instantly?

It takes a few seconds to get data from the servers of our liquidity providers. As a rule, the process of opening a new trade takes up to 4 seconds.

How Can I View the History of My Trades?

All information about your recent trades is available in the “Trades” section. You can access the history of all your trades through the section with the same name as your user account.

Selecting the Trading Conditions

There is a Trading Conditions menu next to the asset chart. To open a trade, you need to select:– The trade amount. The amount of potential profit depends on the chosen value.

– The trade duration. You can set the exact time when the trade closes (for example, 12:55) or just set the trade duration (for example, 12 minutes).

Withdrawal

What Should I Do If the Bank Rejects My Withdrawal Request?

Don’t worry, we can see that your request has been rejected. Unfortunately, the bank doesn’t provide the reason for the rejection. We will send you an email describing what to do in this case.

Why Do I Receive the Requested Amount in Parts?

This situation may arise because of the payment systems’ operational features.You have requested a withdrawal, and you only got part of the requested amount transferred to your card or e-wallet. The withdrawal request status is still “In process”.

Don’t worry. Some banks and payment systems have restrictions on the maximum payout, so a larger amount can be credited to the account in smaller parts.

You will receive the requested amount in full, but the funds will be transferred in a few steps.

Please note: you can only make a new withdrawal request after the previous one has been processed. One cannot make several withdrawal requests at once.

Funds Withdrawal Cancellation

It takes some time to process a withdrawal request. The funds for trading will be available within this entire period.However, if you have less funds in your account than you have requested to withdraw, the withdrawal request will be cancelled automatically.

Besides, сlients themselves can cancel withdrawal requestes by going to the "Transactions" menu of the user account and cancelling the request.

How Long Do You Process Withdrawal Requests

We are doing our best to process all our clients requests as fast as possible. However, it may take from 2 to 5 business days to withdraw the funds. The duration of the request processing depends on the payment method you use.

When Are the Funds Debited from the Account?

Funds are debited from the trading account once a withdrawal request is processed.If your withdrawal request is being processed in parts, the funds will be also debited from your account in parts.

Why Do You Credit a Deposit Straight off but Take Time to Process a Withdrawal?

When you top up, we process the request and credit the funds to your account straight off.Your withdrawal request is processed by the platform and your bank or payment system. It takes more time to complete the request due to an increase of counterparties in the chain. Besides, each payment system has own withdrawal processing period.

On average, funds are credited to a bank card within 2 business days. However, it may take some banks up to 30 days to transfer the funds.

E-wallet holders receive the money once the request is processed by the platform.

Don’t worry if you see the status saying “Payout has been successfully made” in your account but you haven’t received your funds.

It means that we have sent the funds and the withdrawal request is now processed by your bank or payment system. The speed of this process is out of our control.

How Do I Withdraw Funds to 2 Payment Methods

If you topped up with two payment methods, the amount of the deposit you want to withdraw should be proportionally distributed and sent out to these sources.For example, a trader has deposited $40 in their account with a bank card. Later, the trader made a deposit of $100 using the Neteller e-wallet. After that, he or she increased the account balance to $300. This is how the deposited $140 can be withdrawn: $40 should be sent to the bank card $100 should be sent to the Neteller e-wallet Please note that this rule applies only to the amount of funds one has deposited. The profits can be withdrawn to any payment method without restrictions.

Please note that this rule applies only to the amount of funds one has deposited. The profits can be withdrawn to any payment method without restrictions.

We have introduced this rule because as a financial institution, we must comply with international legal regulations. According to these regulations, a withdrawal amount to 2 and more payment methods should be proportional to the deposit amounts made with these methods.